Chomp Market

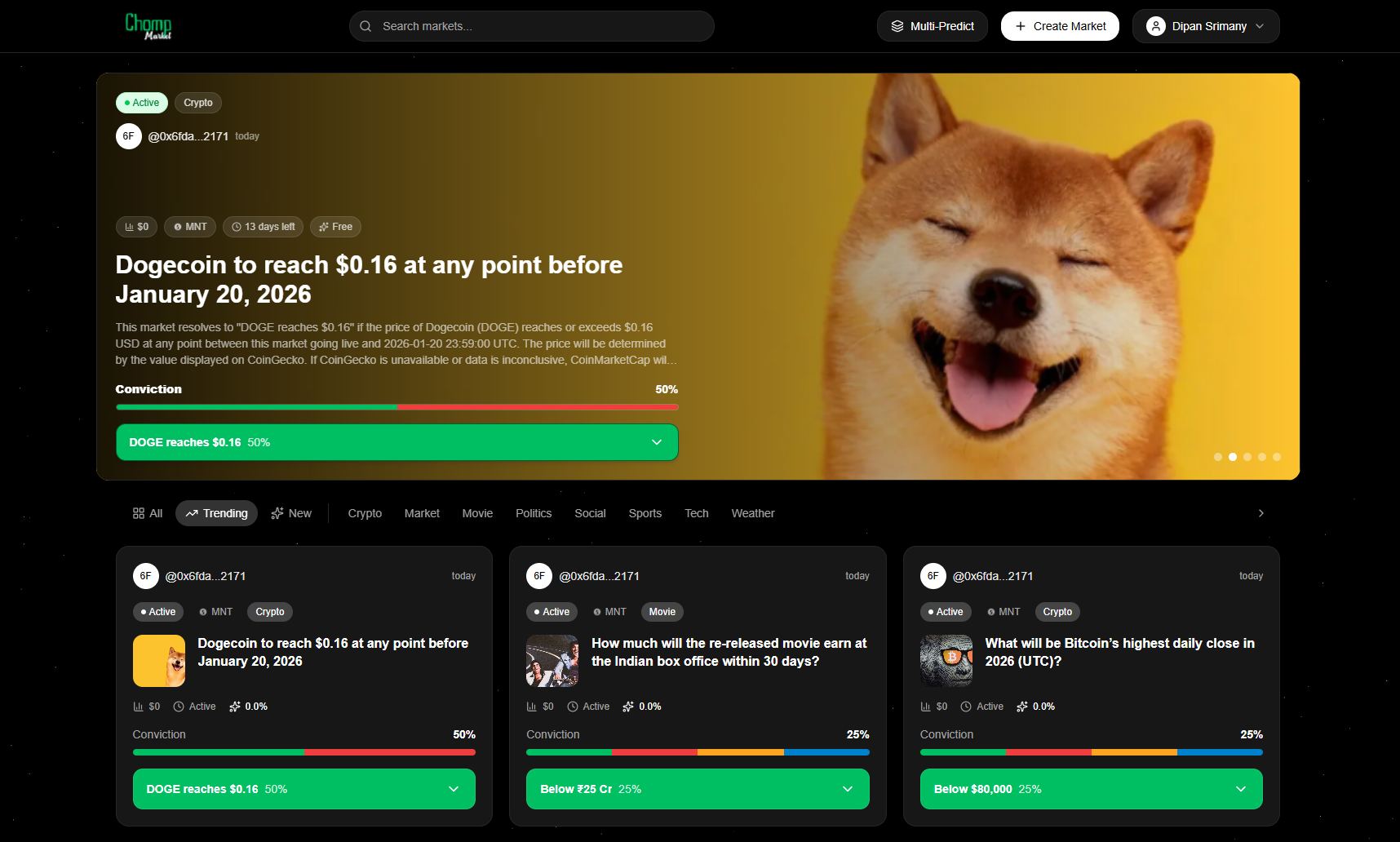

A decentralized permissionless prediction market platform built on the Mantle where users can create, trade, and resolve markets on future events. Users buy and sell shares in custom outcome.

ビデオ

説明

Chomp Market is a decentralized prediction market infrastructure built natively for Mantle L2 that solves the fundamental limitations preventing prediction markets from achieving mainstream adoption: binary-only outcomes, centralized resolution, prohibitive gas costs, and fragmented user experiences.

The numbers reveal a massive untapped opportunity: the global prediction market industry is projected to reach $50+ billion by 2028, yet blockchain-based prediction markets capture less than 1% of this potential. Polymarket processed $3.5 billion in volume during the 2024 US election alone - proving explosive demand exists when the right conditions align. But current platforms leave enormous value on the table.

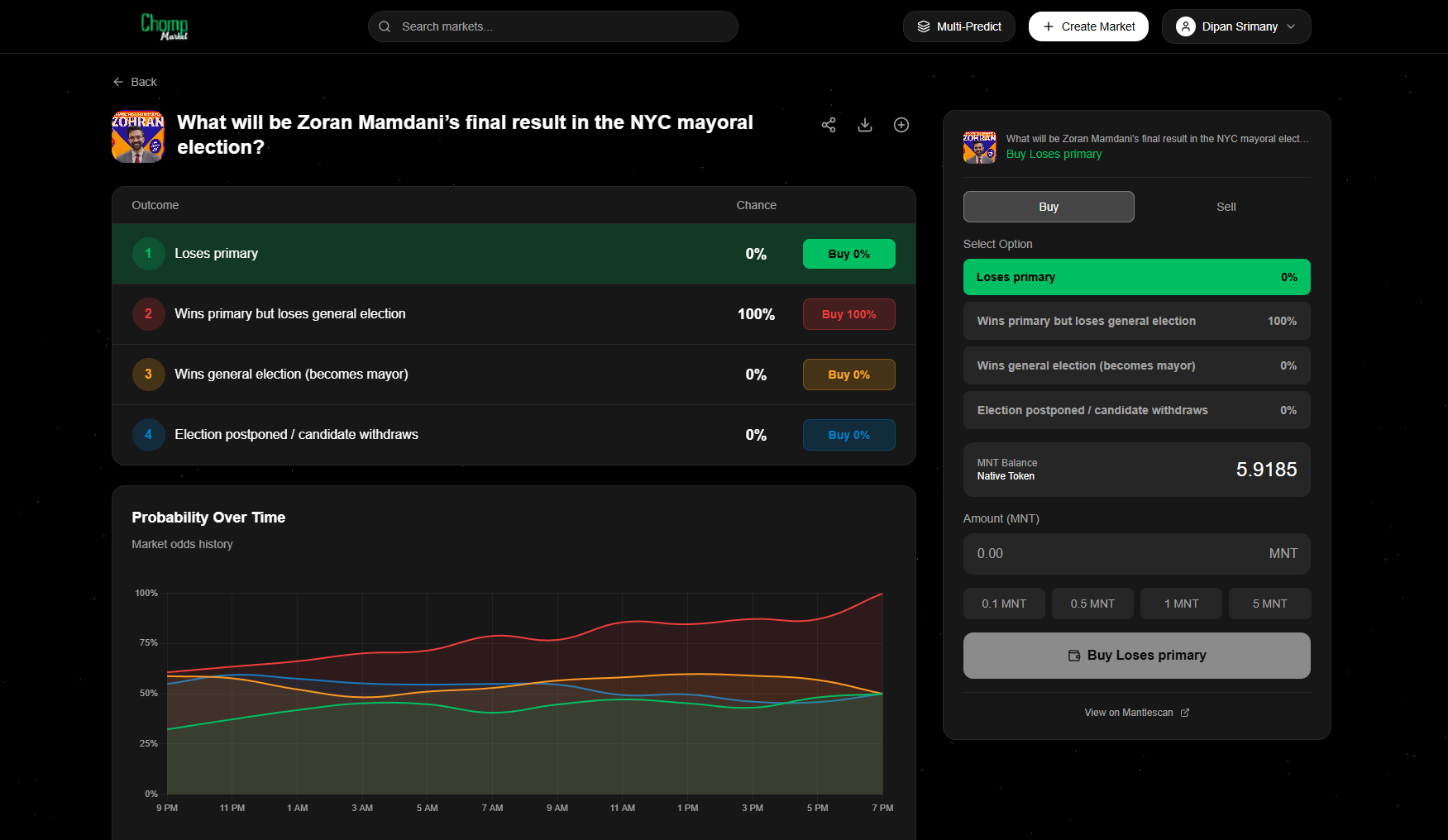

Here's the problem: 95% of real-world predictions aren't binary. "Who will win the election?" has 5+ candidates. "Which team wins the championship?" has 30+ contenders. "What price range will BTC hit?" spans infinite possibilities. Yet almost every prediction market forces complex reality into simplistic Yes/No boxes - distorting odds, limiting expressiveness, and frustrating users who can't bet on what they actually believe.

Worse, centralized resolution creates systemic risk. When Polymarket resolves a controversial market, users must trust the platform's judgment. When that judgment is questioned - as happened with multiple high-profile disputes - there's no recourse. The platform is judge, jury, and executioner. This isn't decentralization; it's Web2 with extra steps.

Finally, Ethereum gas costs of $5-50 per transaction make casual predictions economically irrational. Why bet $10 when gas costs $8? This prices out 99% of potential users and concentrates markets among whales who can absorb friction costs.

The Solution: Multi-Outcome Markets with Decentralized Resolution

Chomp Market introduces a purpose-built architecture that treats prediction markets as first-class DeFi primitives rather than afterthoughts bolted onto general-purpose infrastructure.

How it works:

Market Creation: Users deploy a dedicated smart contract for each prediction via our Factory pattern. They define 2-4 custom outcome options (not just Yes/No), set resolution criteria, specify trusted resolution sources, and configure end dates. Each market is a sovereign contract with its own liquidity pool.

AMM-Powered Trading: Participants buy shares in outcomes using native MNT tokens. Our pool-based Automated Market Maker dynamically adjusts odds based on demand:

Odds = (Option Shares / Total Pool) × 100%No order books. No counterparty matching. Instant execution at algorithmically-determined prices.

Decentralized Resolution: When markets close, resolution happens through one of two paths:

Creator Resolution: Market creator submits winning outcome(s) - suitable for low-stakes or trusted scenarios

MultiDAO Resolution: A multi-signature governance system where designated signers vote on outcomes. Includes bond requirements, slashing for dishonest proposals, and challenge periods for dispute resolution.

Instant Settlement: Winners claim proportional payouts immediately after resolution:

Payout = (User Winning Shares / Total Winning Shares) × Total PoolNo waiting periods. No withdrawal queues. Funds flow directly to wallets.

Technical Architecture & Specifications

The system is built on battle-tested Solidity patterns optimized for Mantle's execution environment:

COMPONENT | SPECIFICATION | WHY IT MATTERS |

|---|---|---|

Contract Pattern | Factory + Individual Markets | Isolation between markets, no shared state risk |

Pricing Model | Pool-based AMM | No liquidity providers needed, instant execution |

Outcome Support | 2-4 Custom Options | Handles 90%+ of real-world prediction scenarios |

Resolution | Creator + MultiDAO | Flexibility for different trust requirements |

Token Standard | Native MNT | No wrapped tokens, single-tx predictions |

Security | OpenZeppelin + ReentrancyGuard | Battle-tested primitives, reentrancy protection |

Smart Contract Architecture:

CONTRACT | PURPOSE | KEY FUNCTIONS |

|---|---|---|

PredictionMarket.sol | Core trading logic |

|

PredictionMarketFactory.sol | Market deployment |

|

MultiDAOResolver.sol | Decentralized resolution |

|

BatchPrediction.sol | Multi-market router |

|

Gas Costs on Mantle:

OPERATION | GAS USED | COST (USD) |

|---|---|---|

Create Market | ~2,500,000 | ~$0.15 |

Buy Shares | ~80,000 | ~$0.005 |

Sell Shares | ~90,000 | ~$0.006 |

Claim Winnings | ~60,000 | ~$0.004 |

Batch Predict (20 markets) | ~1,200,000 | ~$0.08 |

Performance Metrics:

Market deployment: ~3 seconds (single block confirmation)

Trade execution: ~2 seconds

Batch prediction: 20 markets in single transaction

Odds calculation: Real-time, on-chain

Resolution finality: Immediate after threshold reached

Why Mantle? Why Now?

What makes Chomp Market unique is its position as native Mantle infrastructure rather than a ported Ethereum application. We didn't fork Augur or clone Polymarket - we architected specifically for Mantle's strengths.

Mantle is the ideal home for prediction markets:

Ultra-low gas (~0.02 gwei) makes micro-predictions viable - bet $1 without losing half to fees

$500M+ TVL and growing DeFi ecosystem hungry for new primitives

2-second block times enable responsive trading experiences

Ethereum security inheritance through rollup architecture - no new trust assumptions

First-mover advantage - no native prediction market exists on Mantle today

The timing is perfect:

Prediction markets proved product-market fit in 2024 (Polymarket's election volume)

Regulatory clarity emerging in key jurisdictions

L2 infrastructure mature enough for complex DeFi primitives

Mantle ecosystem actively seeking differentiated applications

Use Cases Unlocked

Chomp Market enables prediction scenarios previously impractical on blockchain:

USE CASE | EXAMPLE | WHY IT MATTERS |

|---|---|---|

Multi-Candidate Elections | "Who wins 2028 Presidential Election?" with 5+ candidates | Binary markets can't express this naturally |

Sports Tournaments | "Super Bowl winner?" with all 32 NFL teams as options | Current platforms require multiple binary markets |

Price Range Predictions | "BTC price Dec 31?" with ranges: <$50K, $50-75K, $75-100K, >$100K | Captures nuanced price views |

Award Ceremonies | "Best Picture Oscar?" with 10 nominated films | Natural multi-outcome scenario |

Corporate Events | "Which company acquires Target Corp?" with 4 potential acquirers | M&A speculation with multiple possibilities |

Product Launches | "When does Apple release AR glasses?" with date ranges | Timeline predictions with multiple windows |

Governance Outcomes | "Which proposal passes DAO vote?" with multiple proposals | Meta-governance on governance |

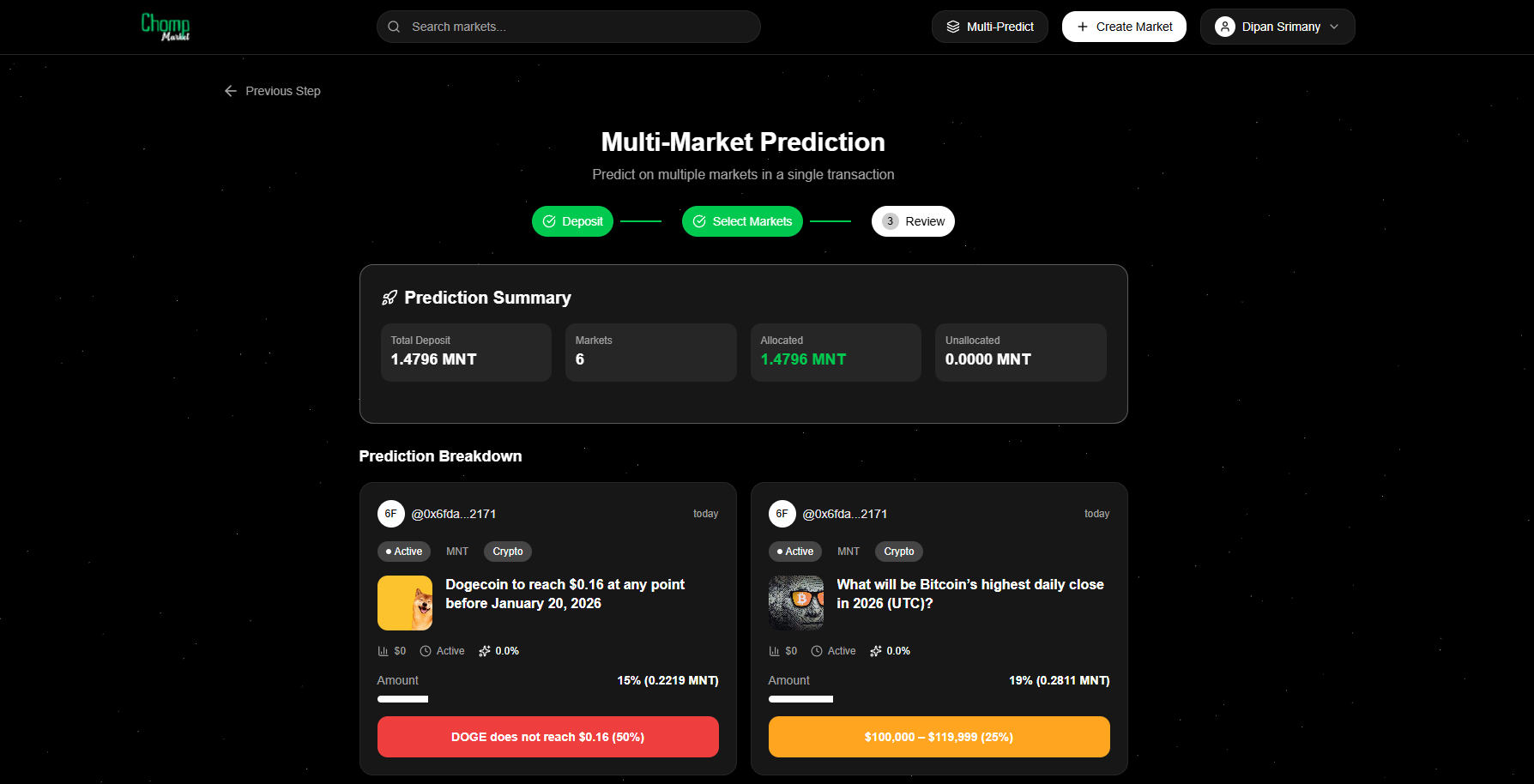

Batch Predictions unlock portfolio strategies:

Hedge across correlated markets in single transaction

Execute complex multi-leg prediction strategies

Reduce gas overhead by 80%+ vs individual transactions

Security Model and Economic Guarantees

PROPERTY | MECHANISM | PROTECTION |

|---|---|---|

Fund Safety | Per-market isolated contracts | Single market compromise doesn't affect others |

No Double-Claim | Claimed mapping per address | Same user can't claim twice |

Resolution Integrity | MultiDAO multi-sig + bonds | Economic cost to propose dishonest outcomes |

Manipulation Resistance | Slashing (10% of bond) | Dishonest proposals lose capital |

Front-running Protection | AMM pricing | No order book to front-run |

Reentrancy | OpenZeppelin ReentrancyGuard | State changes before external calls |

What attackers cannot do:

Drain other markets (isolated contracts)

Double-claim winnings (on-chain claim tracking)

Manipulate resolution for free (bond requirements)

Front-run trades (AMM eliminates order book)

Reentrancy attacks (guard on all external calls)

Create markets with invalid options (2-4 option validation)

Economic Security of MultiDAO Resolution:

Proposer must stake bond to submit outcome

Designated signers vote during challenge period

If approved: resolution executes, bond returned

If rejected: proposer loses 10% of bond (slashed)

Repeated dishonest proposals become economically irrational

Current Status

Chomp Market is currently in testnet MVP with full functionality deployed to Mantle Sepolia. Core trading mechanics, market creation, batch predictions, and creator resolution are production-ready. The MultiDAO resolver is implemented and tested but pending mainnet deployment. The platform handles real transactions with real (testnet) MNT - this isn't a simulation.

Live Deployment:

Factory Contract:

0xF79884A18E7eeDD24d55f1A3BbA745Eb646Fd7f8Batch Prediction:

0x4CE81DB827E2D53a97E57a7A4F4097de976B9f0ANetwork: Mantle Sepolia (Chain ID: 5003)

ハッカソンの進行状況

During this hackathon, we built Chomp Market from concept to fully functional prediction market platform deployed on Mantle Sepolia. We implemented the complete smart contract stack: four Solidity contracts (PredictionMarket.sol for core AMM trading logic with buy/sell/claim/resolve functions, PredictionMarketFactory.sol using factory pattern for market deployment with pagination support, BatchPrediction.sol enabling up to 20 predictions per transaction with automatic refunds, and MultiDAOResolver.sol providing decentralized resolution through multi-signature voting with bond/slashing mechanics) - all built on OpenZeppelin security primitives with comprehensive access control and reentrancy protection. On the frontend, we developed a complete Next.js 16 application with React 19 featuring: a 5-step market creation wizard with category management and image uploads, real-time trading interface with dynamic odds visualization using Recharts, batch prediction UI for portfolio-style betting, user dashboards for created markets and positions, and full watchlist/comments/activity feed social features. The data layer combines MongoDB for market metadata and social features with TanStack Query v5 for optimized caching (15-second stale time, 30-second auto-refresh on market data). Authentication uses Privy.io supporting both embedded wallets for Web3 newcomers and external wallet connections with automatic Mantle network switching. We implemented comprehensive React Query hooks for all data operations (polls, categories, comments, activity, holders, watchlist, market info, user positions, balances) with proper query key organization and cache invalidation. The entire stack was integrated end-to-end: we successfully deployed contracts to Mantle Sepolia, created markets through the UI, executed trades with real testnet MNT, verified AMM pricing adjustments, and tested the complete user journey from market creation to winner payout claims. This represents a complete vertical slice of prediction market infrastructure - from Solidity contracts to polished React UI - built entirely during the hackathon period.

テックスタック

資金調達の状況

Chomp Market is currently in testnet MVP and actively seeking strategic partnerships and grant funding to advance from hackathon prototype to production-ready infrastructure. Our immediate priorities center on: Security Audit ($30-50k): Comprehensive audit of smart contracts by tier-1 auditors before mainnet deployment Mainnet Deployment: Gas optimization, final testing, and production deployment to Mantle mainnet Liquidity Incentives: Initial market creation incentives to bootstrap prediction volume Team Expansion: Frontend engineers for mobile experience, Solidity developers for advanced features (conditional markets, limit orders, liquidity mining) We are specifically interested in partnering with the Mantle ecosystem through grants programs, as Chomp Market represents the first native multi-outcome prediction market for Mantle L2. Beyond grants, we are open to conversations with DeFi-focused investors who understand the massive TAM of prediction markets ($50B+ by 2028) and the unique opportunity to capture this market on an emerging L2 with zero competition. Target raise: $100-250k pre-seed for audit, 6-9 months runway, and mainnet launch infrastructure.