Supala Finance

Supala is a permissionless cross-chain lending protocol, enabling tokenized stocks (RWAs) as collateral with tradeable positions across multiple chains.

ビデオ

テックスタック

説明

Web: https://supala-finance.vercel.app/

Docs: https://supala-finance.gitbook.io/supala-fi-docs

Demo Video:

Overview

Introducing Supala, a permissionless cross-chain lending protocol powered by LayerZero, purpose-built for Real World Assets (RWA) tokenized stocks on the Mantle ecosystem. Supala enables users to collateralize tokenized equities such as AAPL, AMZN, and MSFT, borrow against them across chains, and actively trade their collateral without closing their lending position.

Unlike traditional DeFi lending protocols where collateral becomes static once deposited, Supala introduces a Tradeable Collateral, allowing users to rebalance, rotate, or gain exposure to different tokenized stocks while maintaining open debt positions. This creates a new DeFi primitive where lending, borrowing, and trading are unified into a single capital-efficient workflow.

By combining Mantle’s RWA-first ecosystem with LayerZero’s omnichain messaging, Supala transforms tokenized stocks into fully composable, cross-chain financial building blocks.

Why Mantle Is Supala’s Home Chain

Built Where RWAs Already Live

Mantle has emerged as a natural settlement layer for RWAs and yield-bearing assets. Supala is deployed on Mantle to directly integrate with an ecosystem designed for real-world value, making tokenized stocks first-class collateral on-chain.

Designed for Active Collateral Management

Supala’s core innovation, tradeable collateral requires frequent updates, low-latency execution, and minimal transaction costs. Mantle’s modular design enables this without sacrificing user experience or capital efficiency.

Secure Settlement for Real-Value Assets

Tokenized equities represent real economic value. Mantle’s Ethereum-backed security and fast finality provide the settlement assurances needed for lending protocols handling RWAs at scale.

What Supala Unlocks for the Mantle Ecosystem

From Passive RWAs to Productive Capital

Supala turns tokenized stocks from static holdings into active financial instruments enabling borrowing, leverage, and portfolio optimization without liquidating long-term equity exposure.

A New Lending Primitive: Trade While Borrowing

Supala introduces a lending model where users can trade their collateral without closing positions, expanding Mantle’s DeFi design space beyond conventional overcollateralized lending.

Omnichain Liquidity, Mantle Settlement

Through LayerZero, Supala aggregates liquidity and users from multiple chains while keeping Mantle as the settlement and risk engine, positioning Mantle as a cross-chain RWA liquidity hub.

Institutional-Ready DeFi Foundations

With RWAs, predictable collateral behavior, and flexible risk management, Supala provides the base layer for institutional DeFi use cases on Mantle, without permissions or custodians.

Problem

Fragmented RWA Liquidity Across Chains

Tokenized stocks are issued and distributed across multiple chains and ecosystems. This fragmentation prevents users from efficiently using their RWA assets as collateral outside their origin chain and significantly reduces overall capital efficiency.

No Native Cross-Chain Borrowing

Most lending protocols are confined to a single chain. Even when RWAs exist on multiple networks, users cannot borrow liquidity cross-chain against the same collateral, forcing unnecessary bridging, asset duplication, or full position unwinding.

Static Collateral in Lending Protocols

Once collateral is deposited, it becomes locked and unusable. Users are unable to rebalance or adjust their collateral portfolio without fully closing their borrowing position, limiting flexibility and increasing friction.

Limited Utility of Tokenized Stocks

Tokenized equities largely remain passive assets on-chain. Without integrated lending, cross-chain borrowing, and active collateral management, their potential as core DeFi primitives remains unrealized.

Solution

Unified Omnichain Borrowing

Supala enables users to borrow assets cross-chain against a single collateral position. Using LayerZero, collateral can remain on Mantle while borrowed liquidity is delivered to the user’s destination chain.

Cross-Chain Liquidity Without Fragmentation

By abstracting away manual bridging, Supala consolidates fragmented RWA liquidity into one risk engine. Users gain access to cross-chain capital while maintaining a unified collateral position.

Tradeable Collateral Layer

Supala allows users to trade, rotate, or rebalance their collateral without closing their debt position. This creates a continuous, capital-efficient workflow for managing tokenized stock portfolios.

Productive RWAs by Design

Supala turns tokenized stocks into fully composable assets that can be borrowed against, actively managed, and deployed across chains within Mantle’s RWA-focused ecosystem.

Features

Tokenized Stocks as Collateral

Supala supports tokenized equities such as AAPL, MSFT, and AMZN as first-class collateral assets. Users can deposit stock-backed tokens and unlock on-chain liquidity without selling their equity exposure. Additional tokenized stocks and RWA assets will be supported as the ecosystem expands.

Cross-Chain Borrowing

Supala enables users to borrow assets across chains using a single collateral position. Powered by LayerZero, collateral remains secured on Mantle while borrowed liquidity can be delivered to the user’s destination chain, eliminating the need for manual bridging or duplicated positions.

Tradeable Collateral

Supala introduces a tradeable collateral layer that allows users to actively trade, rebalance, or rotate their collateral while maintaining open borrowing positions. This enables continuous portfolio management, improves capital efficiency, and unlocks a new DeFi primitive where lending and trading coexist seamlessly.

Supala’s Role in Advancing the Mantle Ecosystem

Expanding Mantle’s RWA Utility

Supala transforms tokenized stocks on Mantle from passive representations into productive, on-chain collateral. This increases the real economic activity of RWAs within Mantle’s ecosystem.

Establishing Mantle as the Omnichain RWA Hub

By anchoring collateral and risk management on Mantle while enabling cross-chain borrowing via LayerZero, Supala positions Mantle as the central settlement layer for omnichain RWA liquidity.

Introducing a New DeFi Lending Primitive

Supala’s tradeable collateral model unlocks a new design space for DeFi on Mantle, enabling lending, borrowing, and active portfolio management to coexist in a single protocol.

Driving Liquidity and User Growth

Supala attracts cross-chain users, RWA holders, and advanced DeFi participants into Mantle, increasing TVL, transaction volume, and ecosystem stickiness.

Laying the Foundation for Institutional DeFi

With permissionless access, predictable collateral behavior, and real-world-backed assets, Supala provides core infrastructure that can support future institutional-grade financial products on Mantle.

Activating Mantle’s DeFi and RWA Infrastructure

Leveraging Mantle as the Core Risk Engine

Supala anchors collateral management, pricing, and liquidation logic directly on Mantle. This ensures that all RWA-backed positions are secured and settled within Mantle’s execution environment.

Integrating with Mantle-Native Liquidity

Supala is designed to interoperate with Mantle-native liquidity venues and DeFi protocols. Borrowed assets and collateral flows can seamlessly interact with existing money markets and trading infrastructure on Mantle.

Expanding Omnichain Connectivity via LayerZero

Supala uses LayerZero to connect Mantle with external ecosystems. This allows Mantle-based RWA collateral to be utilized across multiple chains while maintaining a unified protocol state on Mantle.

Enabling Builders Through Composable Primitives

Supala exposes its lending, borrowing, and tradeable collateral mechanisms as composable primitives. Developers can build structured products, leverage strategies, and advanced RWA applications directly on top of Mantle.

Supala Roadmap

Our Product: Cross-Chain Borrowing

Supala enables seamless cross-chain borrowing using a single collateral position secured on Mantle. Users can deposit tokenized stocks as collateral on Mantle and receive borrowed liquidity directly on their destination chain without manually bridging assets or duplicating positions.

By leveraging LayerZero, Supala abstracts cross-chain complexity while maintaining a unified risk engine. Collateral valuation, health factor calculation, and liquidation logic remain on Mantle, ensuring protocol safety even as liquidity moves across chains.

This design allows users to access capital wherever it is most needed while keeping RWAs efficiently deployed. Cross-chain borrowing through Supala unlocks capital efficiency, reduces friction, and positions Mantle as the settlement hub for omnichain RWA lending.

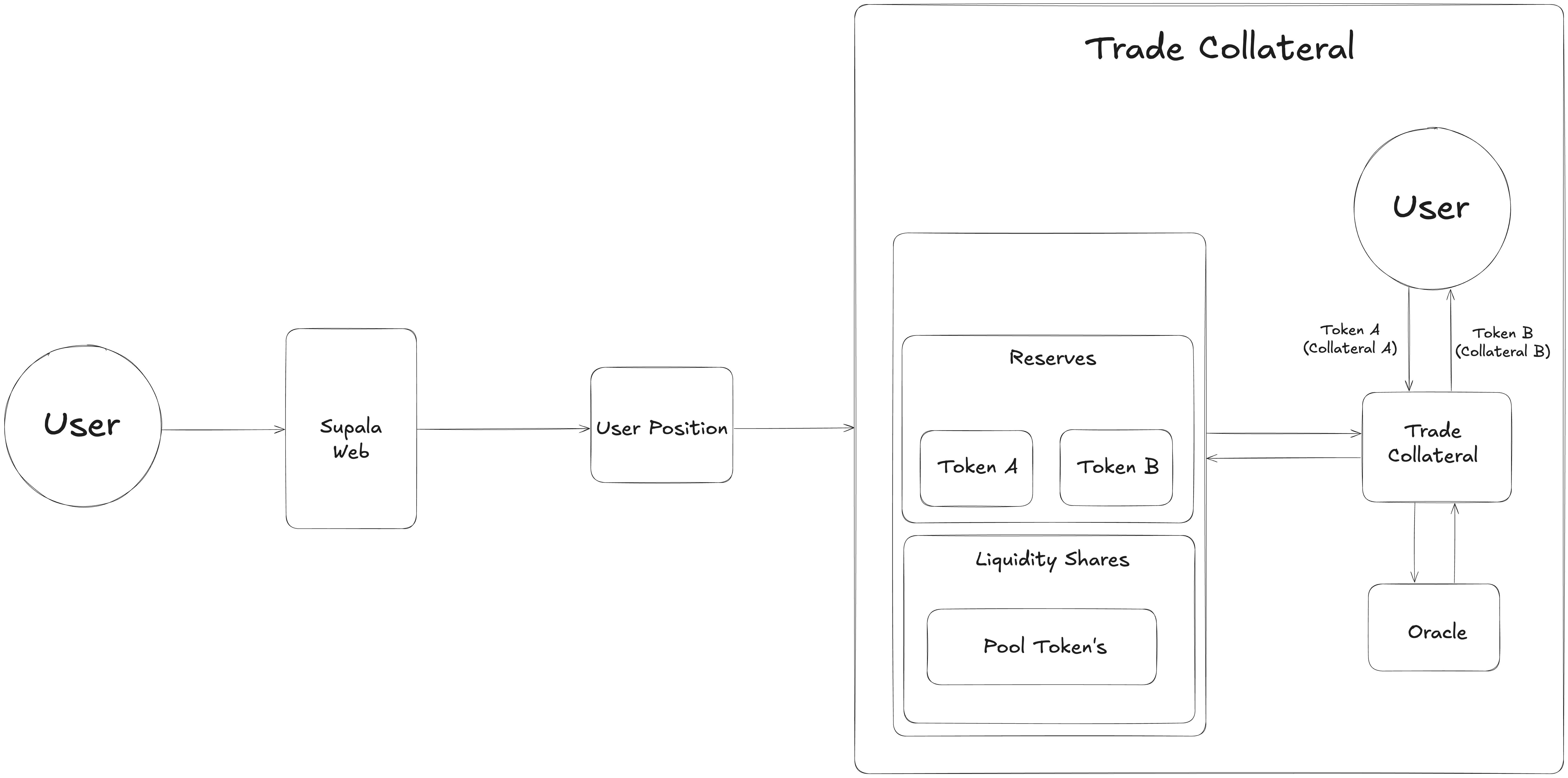

Our Product: Trade Collateral

Supala introduces a tradeable collateral mechanism that allows users to actively manage their collateral without closing existing borrowing positions. Unlike traditional lending protocols where collateral is static, Supala enables users to trade, rebalance, or rotate tokenized stock collateral while maintaining open debt.

This feature allows users to adjust portfolio exposure, respond to market conditions, and optimize risk without incurring the cost of repaying loans or re-opening positions. Collateral trades are executed within protocol-defined risk parameters to ensure position safety and prevent undercollateralization.

Tradeable collateral transforms lending from a passive action into an active capital management strategy, unlocking a new DeFi primitive where borrowing and trading operate in parallel.

How Supala Work: Architecture

How Supala Work: Supply Liquidity

How Supala Work: Supply Collateral

How Supala Work: Cross-Chain Borrowing

How Supala Work: Repay

How Supala Work: Trade Collateral

Contract Addresses

Mantle Testnet

MANTLE TESTNET MOCK USDT = 0xdF05e9AbF64dA281B3cBd8aC3581022eC4841FB2

MANTLE TESTNET MOCK USDC = 0x04C37dc1b538E00b31e6bc883E16d97cD7937a10

MANTLE TESTNET MOCK WMNT = 0x15858A57854BBf0DF60A737811d50e1Ee785f9bc

MANTLE TESTNET MOCK WETH = 0x4Ba8D8083e7F3652CCB084C32652e68566E9Ef23

MANTLE TESTNET MOCK WBTC = 0x007F735Fd070DeD4B0B58D430c392Ff0190eC20F

MANTLE TESTNET MOCK AAPLX = 0x56f9Cbd1aeb705b440357097eE13eBe8AA755357

MANTLE TESTNET MOCK AMZNX = 0xAF0C7edB6D33e166719f4d528D33042768367E28

MANTLE TESTNET MOCK MSFTX = 0x7Cc335F6693077B391B767df16295DABd9288144

MANTLE TESTNET MOCK DEX = 0x5C368bd6cE77b2ca47B4ba791fCC1f1645591c84

MANTLE TESTNET USDT ELEVATED MINTER BURNER = 0x26149BD6a6d2e2CfB358852a7EA186aFE58591E1

MANTLE TESTNET USDT OFT ADAPTER = 0xa7f7368b6CBdF2bE4d508ad85d2CC1F3248a9ED5

MANTLE TESTNET USDC ELEVATED MINTER BURNER = 0xeD095E8dd2d72A8306fbEa923bff5091C000e963

MANTLE TESTNET USDC OFT ADAPTER = 0x64493Bd2F250cC05D75bCa93cc95447e2834638b

MANTLE TESTNET WMNT ELEVATED MINTER BURNER = 0x39926DA4905f5Edb956F5dB5F2e2FF044E0882B2

MANTLE TESTNET WMNT OFT ADAPTER = 0xAE1b8d3B428d6A8F62df2f623081EAC8734168fe

MANTLE TESTNET WETH ELEVATED MINTER BURNER = 0xF0D1c69cc148db2437131a5A736d77FD6fa20B47

MANTLE TESTNET WETH OFT ADAPTER = 0x487b1e0177B3ac1ACA7e8c353ed0Df133593a8EB

MANTLE TESTNET WBTC ELEVATED MINTER BURNER = 0xe5D4C481e25880eaD3A1647A210A9f219204f3CA

MANTLE TESTNET WBTC OFT ADAPTER = 0xC746B3AaB0C6Da075C9b7b43CEebd437Ef759D5b

MANTLE TESTNET TOKEN DATA STREAM IMPLEMENTATION = 0x7B3C20D2B3F8C205f624e62D356354Ed1Ae9F64b

MANTLE TESTNET TOKEN DATA STREAM = 0x10FD0d8280E94D0DbC3013b778Ef26d47105Ea7b

MANTLE TESTNET INTEREST RATE MODEL IMPLEMENTATION = 0x5C43afab54BD5E5568d0aD54ea60D4d065303C35

MANTLE TESTNET INTEREST RATE MODEL = 0xBdC661EECb0dcFB940A34008e0190c9103013C41

MANTLE TESTNET LENDING POOL DEPLOYER = 0x31fC86E13108A098830eea63A8A9f6d80DfC89Aa

MANTLE TESTNET LENDING POOL ROUTER DEPLOYER = 0x02a66B51Fc24E08535a6Cfe1e11E532D8A089212

MANTLE TESTNET POSITION DEPLOYER = 0x4852Bc014401415C4CE4788A04cAB019d1527aAa

MANTLE TESTNET PROXY DEPLOYER = 0xb516190F8192CCEaF8B1DA7D9Ca1C6C75b9F410c

MANTLE TESTNET SHARES TOKEN DEPLOYER = 0x33FaBa0e0cE340AfC4fb03038151FF7EE1d5f95b

MANTLE TESTNET IS HEALTHY IMPLEMENTATION = 0xc3be8ab4CA0cefE3119A765b324bBDF54a16A65b

MANTLE TESTNET IS HEALTHY = 0xE2e025Ff8a8adB2561e3C631B5a03842b9A1Ae88

MANTLE TESTNET PROTOCOL = 0x5E6AAd48fB0a23E9540A5EAFfb87846E8ef04C42

MANTLE TESTNET LENDING POOL FACTORY IMPLEMENTATION = 0x718b1b67f287571767452CC7d24BCD95c63DbA13

MANTLE TESTNET LENDING POOL FACTORY = 0x46dA9F76c20a752132dDaefD2B14870e0A152D71

MANTLE TESTNET SUPALA EMITTER IMPLEMENTATION = 0xC72f2eb4A97F19ecD0C10b5201676a10B6D8bB67

MANTLE TESTNET SUPALA EMITTER = 0x46638aD472507482B7D5ba45124E93D16bc97eCE

MANTLE TESTNET HELPER UTILS = 0x6c454d20F4CB5f69e2D66693fA8deE931D7432dF

Base Sepolia

BASE TESTNET SUSDC IMPLEMENTATION = 0x53D7f02e72d62f7b7B41F6B622A7d79694BED966

BASE TESTNET SUSDC = 0xd506b22a6b3216b736021FA262D0F5D686e07b35

BASE TESTNET SUSDT IMPLEMENTATION = 0x5C43afab54BD5E5568d0aD54ea60D4d065303C35

BASE TESTNET SUSDT = 0xBdC661EECb0dcFB940A34008e0190c9103013C41

BASE TESTNET SUSDT ELEVATED MINTER BURNER = 0x31fC86E13108A098830eea63A8A9f6d80DfC89Aa

BASE TESTNET SUSDT OFT ADAPTER = 0x02a66B51Fc24E08535a6Cfe1e11E532D8A089212

BASE TESTNET SUSDC ELEVATED MINTER BURNER = 0xb516190F8192CCEaF8B1DA7D9Ca1C6C75b9F410c

BASE TESTNET SUSDC OFT ADAPTER = 0x33FaBa0e0cE340AfC4fb03038151FF7EE1d5f95b