Imagine Spotify Wrapped for your finances. FinSafe AI is a proactive assistant on Zalo, delivering a unique monthly ‘Financial Wrapped’ and protecting you from hidden subscription fees.

FinSafe AI – A proactive financial assistant on Zalo that personalizes advice, intelligently predicts needs, and seamlessly connects with the Sovico ecosystem.

Project Summary

FinSafe AI is a groundbreaking initiative to transform HDBank's chatbot into a true Proactive Financial Assistant, powered by an AI Agent on the familiar Zalo platform. Instead of sending mass notifications, FinSafe AI focuses on understanding, predicting, and responding to the financial needs of each individual customer. The system will proactively send suggestions, advice, and offers via Zalo/SMS at the right moment, with content deeply personalized based on the user's "Financial Fingerprint" and spending behavior. Breakthrough features like the Subscription Guardian and Predictive Shopping Assistant not only help customers manage their finances better but also protect them from unwanted expenses. The entire experience is designed to turn "annoying" bank messages into "valuable" advice, while fully leveraging the benefits of the Sovico ecosystem (VietJet, Sovico Resort, HD Saison), creating a unique value loop for both customers and HDBank.

Problem & Opportunity

User Problem: Users are overloaded with generic, irrelevant promotional messages from banks, leading to a tendency to ignore them and miss out on genuinely valuable financial opportunities. They lack a proactive, understanding tool to accompany and protect their personal finances.

Bank Problem: A gradual loss of effective communication channels with customers, low service conversion rates due to non-personalized messaging, and untapped potential within the multi-industry ecosystem.

Opportunity: To build a user-centric experience (persona-driven UX) combined with calibrated intervention timing and ecosystem integration to create a reliable, helpful, and truly differentiated financial assistant in the market.

Solution & Key Components

1. Personalized AI Consultation & Interaction

Persona-based AI: Users can choose a communication style for their virtual assistant (Friendly, Professional, Fun), making every interaction more familiar and natural.

Spending Optimization & Smart Suggestions: Analyzes behavior to offer tailored combo deals, savings tips, or consumer loans, with benefits presented in clear figures to drive action.

Interactive Challenges (Gamification): "Gamifies" financial activities (e.g., "Complete 10 transactions to receive a VietJet voucher"), turning financial management into an enjoyable journey.

2. Proactive AI Protection & Security

Smart Fraud Detection: Monitors transactions 24/7 and allows customers to respond instantly via Zalo/SMS upon detecting suspicious activity, mitigating risks quickly.

3. Sovico Ecosystem Integration

From Transactions to Rewards: Connects financial actions with tangible rewards.

Example: Open a savings account → Receive a 15% discount on VietJet airfare. Reach a spending milestone → Receive a vacation voucher for Sovico Resort.

4. Technology Architecture & Control

Automation Platform (n8n): Acts as the coordinating brain for workflows, integrating the AI Agent to analyze and make intelligent decisions.

Artificial Intelligence (LLM & RAG): Analyzes big data to generate personalized suggestions and retrieves information from multiple sources (FAQs, promotions) for accurate responses.

Communication Channel (Zalo API): A friendly bridge to reach customers where they are most active.

Strict Control Mechanisms:

Automatically checks to avoid suggesting services the customer already has.

Verifies the customer's financial conditions before providing advice.

Automatically transfers to a human support agent for complex requests.

4. Development Potential

Financial Fingerprint: Each month, the AI will summarize and tell the user's spending story through a unique archetype (e.g., "The Stylish Explorer," "The Home Builder"), turning dry data into an exciting self-discovery experience and creating a strong emotional connection.

Service Performance Evaluation: Analyzes customer interaction and feedback via the chatbot to measure changes in satisfaction and the effectiveness of banking service usage, thereby optimizing and improving service quality.

Subscription Guardian: The AI automatically detects and warns about unusual or unwanted recurring service fees (e.g., expired trial packages), proactively protecting the customer's wallet.

End-to-End User Flow

The user activates FinSafe AI on HDBank and chooses a personality for the assistant → The platform of use switches to Zalo → The AI begins analyzing data and identifying spending patterns → The system proactively sends interactive messages: it could be a monthly "Financial Fingerprint" summary, a "Subscription Guardian" alert about a strange fee, or an offer from the Sovico ecosystem when a suitable opportunity is detected → The user can ask further questions, and the chatbot responds intelligently based on RAG → When the user agrees to a service (e.g., opening a savings account), the chatbot sends a secure deep link, leading directly to the corresponding feature in the HDBank App → The user logs in and securely completes the transaction within the bank's application.

Operating Principles Based on the Fundamental Build Model:

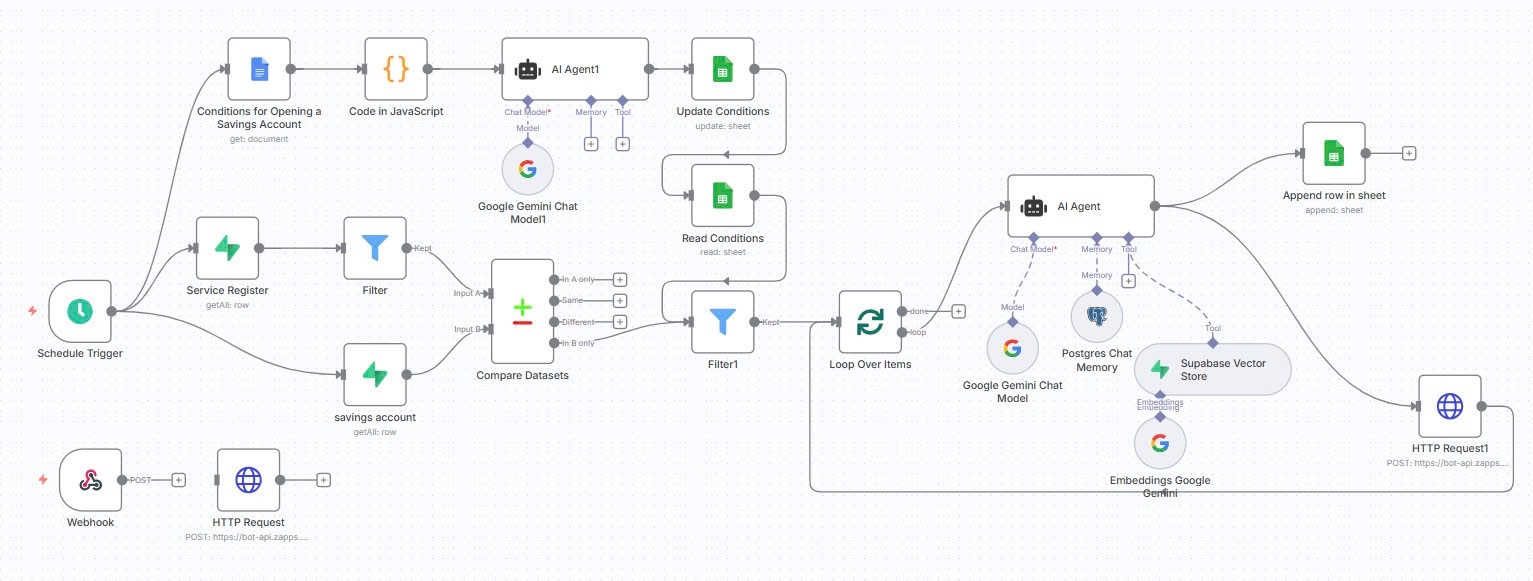

Trigger: The process is initiated by two mechanisms:

Schedule Trigger: Runs automatically at a predefined time.

Via Webhook: Activated by an event from an external system through an HTTP Request.

Data Collection and Pre-processing: Data from sources (Service Register, savings account) is collected, then undergoes filtering (Filter) and comparison (Compare Datasets) steps to identify records that need processing. A JavaScript Code module is used to apply complex business logic.

AI-powered Analysis and Decision-Making: This is the core component of the system, utilizing two AI Agents built on the Google Gemini platform:

AI Agent 1: Processes initial conditions and has the ability to update rules in a spreadsheet (Update Conditions).

AI Agent 2 (Within a loop): Processes each data item individually. This agent's capabilities are enhanced by the Retrieval-Augmented Generation (RAG) architecture:

Knowledge Base: Uses Supabase Vector Store combined with Google's Embeddings technology to store and retrieve relevant information based on semantics, providing the AI with deep knowledge.

Contextual Memory: Integrates with Postgres Chat Memory to store interaction history, allowing the AI to maintain context across multiple processing steps, leading to more consistent and accurate decisions.

Task Execution: Based on the analysis results from AI Agent 2, the system automatically performs output actions, such as appending a new row to a spreadsheet or sending an HTTP Request to another service.

Key Technologies:

Language Model: Google Gemini.

AI Architecture: Retrieval-Augmented Generation (RAG).

Vector Storage: Supabase Vector Store.

Memory Database: PostgreSQL.

Technologies Used

n8n (Workflow Automation)

Zalo API (Communication)

MySQL (Database)

LLM (Large Language Models)

Python (Backend Logic)

OAuth 2.0 & JWT (Security)

A refined idea, ready for the development and testing phase.