Mantle USD is a Mantle-native, over-collateralized stablecoin protocol designed to bridge on-chain liquidity with regulated real-world assets (RWAs) in a privacy-preserving way.

At its core, the protocol allows users to lock mETH as collateral and mint mUSD, a Mantle-native stablecoin designed to be easy to use across DeFi and compliant real-world asset markets.

The minting and redemption flow is intentionally simple: users lock mETH, mint mUSD up to a fixed collateral ratio, and can later repay mUSD to unlock their collateral. This core mechanism forms the foundation of the protocol.

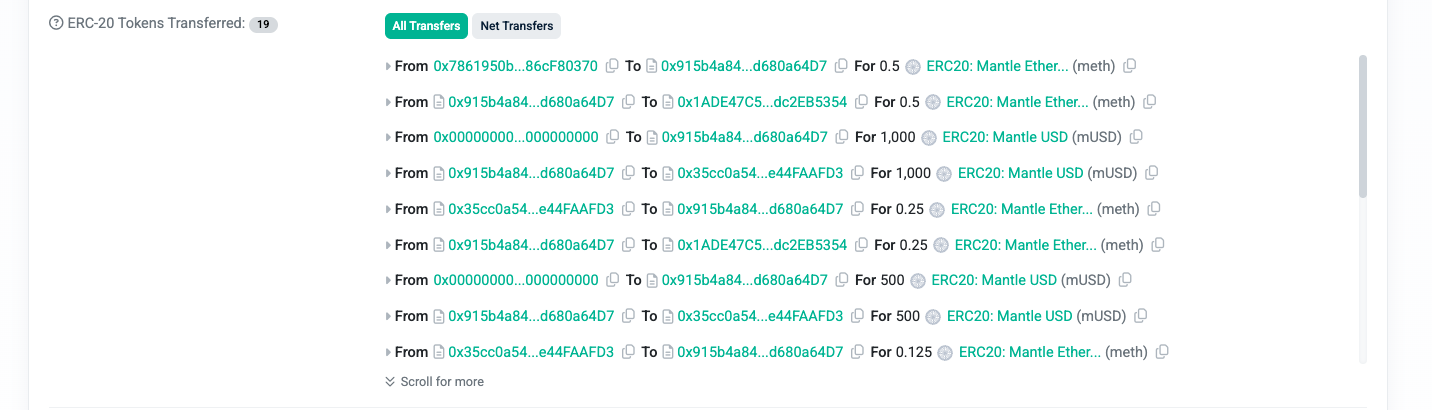

To improve capital efficiency, the protocol includes Super-Stake, a controlled leverage mechanism that allows users to increase their staking exposure through a bounded recursive process. Super-Stake automates what would otherwise be a manual loop, while keeping leverage within protocol-defined limits.

Reference transaction (example Super-Stake execution): https://sepolia.mantlescan.xyz/tx/0x95eedc1f67cfb779db7ef6662a65ff50d2931133d61652411889566087cd1f9d

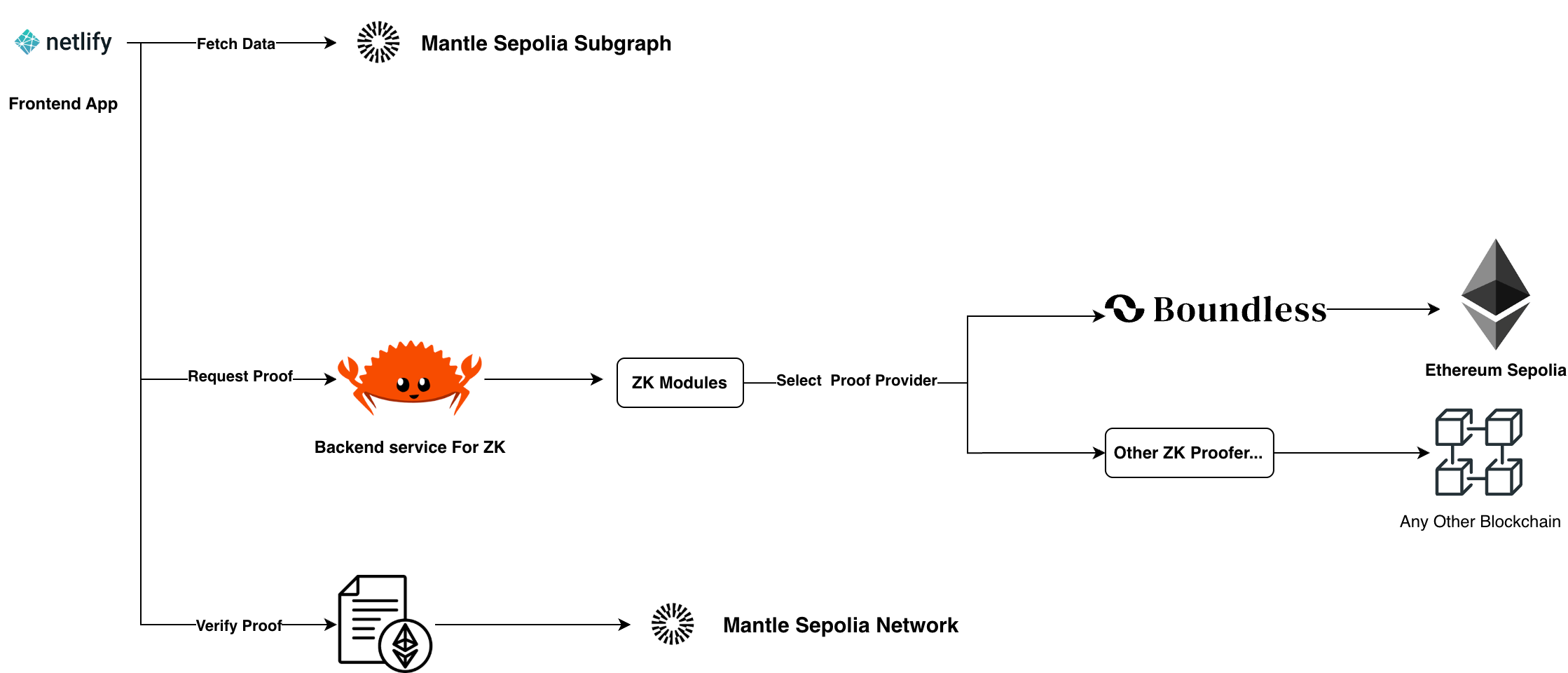

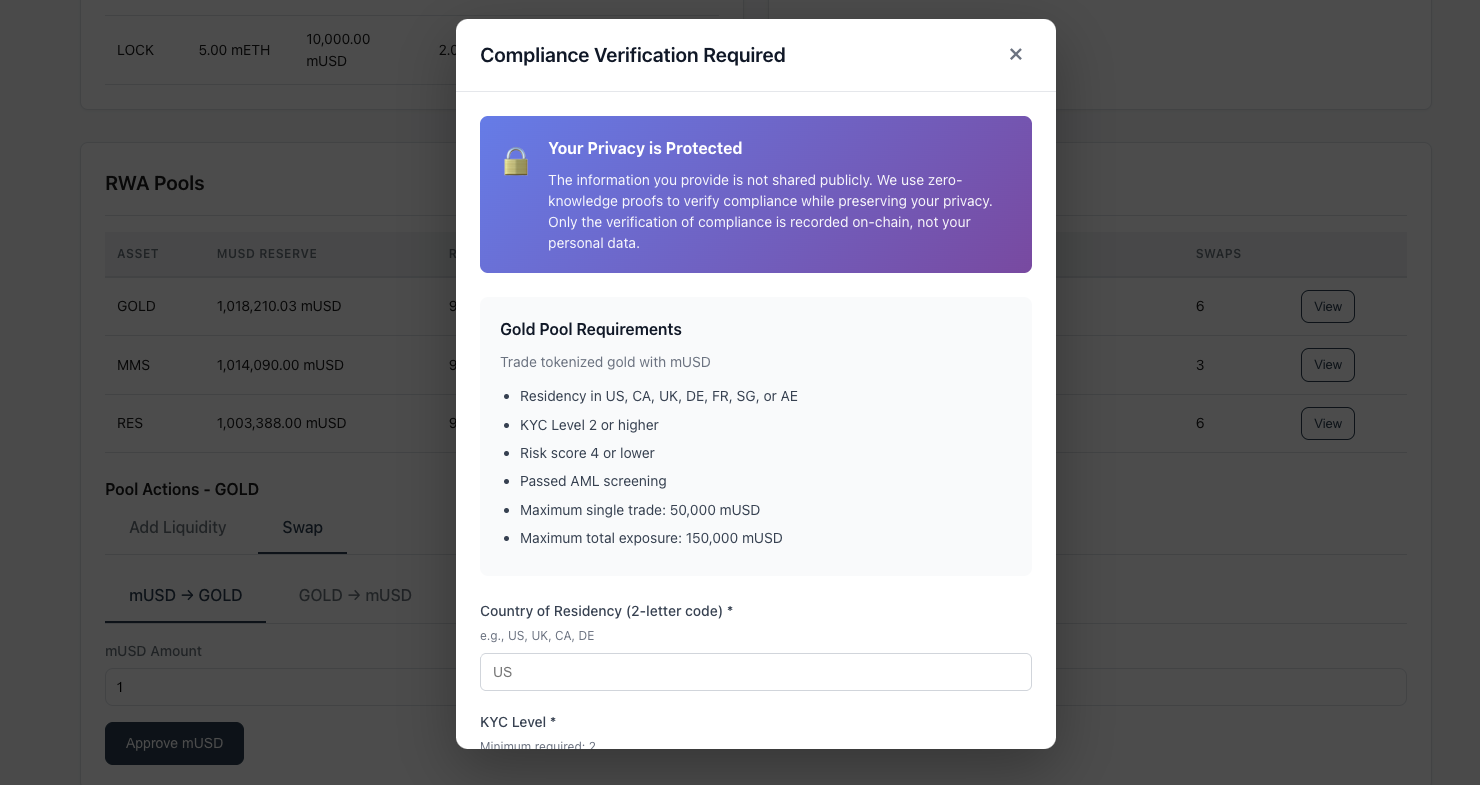

On top of the stablecoin layer, the protocol introduces Compliant RWA Pools , on-chain liquidity pools that enable trading between mUSD and real-world assets such as gold, money-market instruments, real estate shares, and bonds. Each pool enforces asset-specific compliance rules using zero-knowledge proofs, allowing users to prove eligibility without exposing personal data on-chain.

Compliance logic is handled off-chain through a modular proofer system, while verification happens on-chain. This separation keeps the system flexible and privacy-preserving, and allows different assets, jurisdictions, and ZK providers to coexist within the same protocol without forcing a single global compliance model.

Together, Mantle USD and Compliant RWA Pools provide a practical foundation for building privacy-aware and regulation-friendly DeFi on Mantle, without adding unnecessary complexity for users or developers.

Why use a stablecoin as the base asset for RWA markets?

Real-world assets are priced in fiat. Using a stablecoin makes settlement simple, predictable, and compliant.

Why not just issue RWA tokens directly?

If a product is not compliant, it does not work. Many tokenized assets only work in limited jurisdictions. That does not scale.

Why is compliance enforced per pool?

Each asset has different rules. One global rule does not work for all assets.

Why Mantle for mUSD?

Mantle makes mUSD practical to use. Low costs and good composability matter.

Why use Boundless?

Boundless is a decentralized marketplace for proofs. It allows compliance checks without relying on a single prover.

Why not run a prover directly?

Running a single prover creates a central point of trust. Boundless removes that dependency.

Can the system work with other ZK providers?

Yes. Boundless is one option, not a hard dependency.

Why is the Rust service modular?

Different RWA providers have different requirements. The system must support different ZK services without changing the protocol.

What is the risk for liquidity providers?

Liquidity providers take market risk, just like in any AMM. They are exposed to price movements between mUSD and the RWA.

When do liquidity providers benefit the most?

Liquidity providers benefit when market demand moves against trader expectations.

In that case, LPs capture fees and price adjustments.

Can liquidity providers choose which markets to support?

Yes. Each pool is independent, so LPs choose assets, providers, and risk profiles.

https://docs.google.com/presentation/d/17HaCssYgY5ZTQp_x2ts67K44u-KXvufb3JsnVtgAqBQ