Back

Moonshot Mafia #03 | DODO: How to Enter the World of Crypto

Fireside Chats

By Moonshot Commons

Mar 29,202313 min read

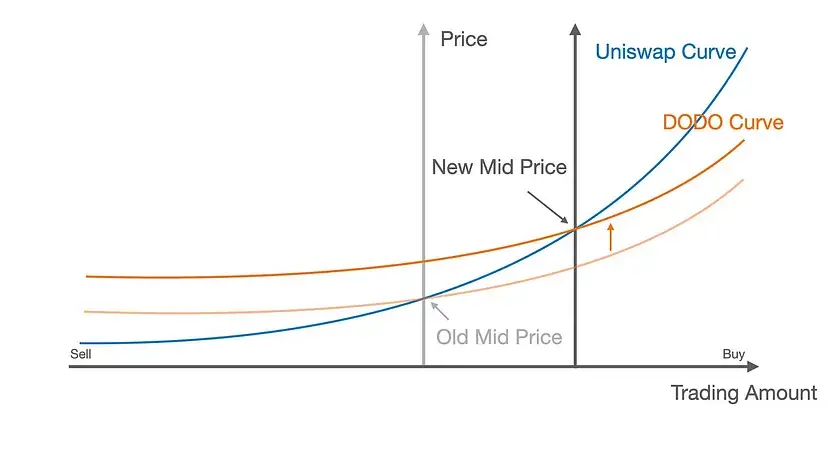

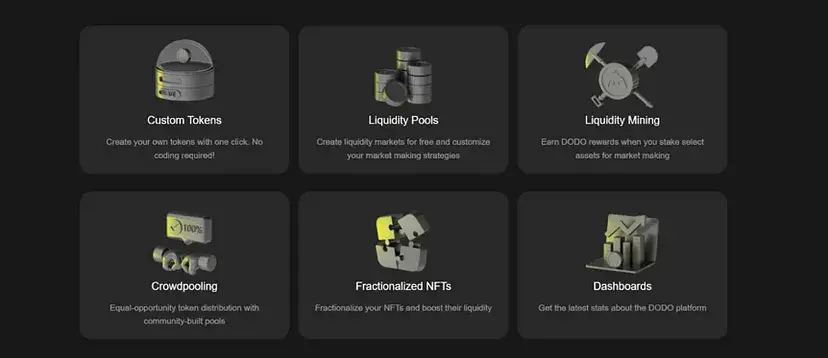

“DODO is a decentralized exchange platform powered by the Proactive Market Maker (PMM) algorithm. It features highly capital-efficient liquidity pools that support single-token provision, reduce impermanent loss, and minimize slippage for traders. The trading platform also offers SmartTrade, a decentralized liquidity aggregation service that routes to and compares various liquidity sources to quote the optimal swap rate between any two tokens. In addition, DODO removed all roadblocks hindering liquidity pool creation for the issuance of new assets — asset ratios, liquidity depths, fee rates, and other parameters can all be freely customized and configured in real-time. Based on this breakthrough, DODO has developed Crowdpooling, a permissionless, equal opportunity liquidity offering mechanic, as well as customizable technical solutions geared towards professional on-chain market makers.” (Visit DODO V2 docs for more information)

In 2020, Daidai established DODO with two partners.

Soon, DODO received the first financing from Framework Ventures, a well-known investment institution in the field. Today, this decentralized exchange established less than two years ago has more than 2 million trading users and a transaction size of 50 billion US dollars around the world.

At Moonshot Commons’ Web3 Fireside Chat #3, we invited Daidai, co-founder of DODO, to talk about her personal background, entrepreneurial journey with DODO, and DeFi’s past, present, and future.

Special shoutout to Tina, investment director of ZhenFund and our community mentor, for moderating this conversation.

Key Takeaways:

1.Crypto is a blue ocean track with immense opportunities. But, it is important to remember that all industries have cycles.

2.Evaluating DeFi products should shift from TVL (Total Value Locked) to EVM(Ethereum Virtual Machine), and strive for greater capital efficiency.

3.The future development trend of DeFi must include cross-chain DEX, scenario finance, and liquidity solutions for a diverse range of assets.

4.Remote work requires preparation and a good set of collaboration tools.

5.Remote work should include a meeting system to maintain regular updates.

6.It is important to find the right, capable people who believe in you and trust you.

Moonshot Commons:

Can you briefly introduce yourself and share the story behind the founding of DODO?

Daidai:

Thrilled to be here and chat with all the brilliant minds in our community!

Let me briefly introduce my experience. I graduated from Nankai University. Around 2016 while I was still studying in school, there was already an immense entrepreneurial momentum in China. At that time, I was an intern at 36Kr and got in touch with many entrepreneurs and investors. In 2017, through the introduction of a senior student at my university, I joined ZhenFund to do marketing and post-investment work. The Crypto market was in a bull market at that time. A lot of people at ZhenFund were passionate about it, and I was one of them.

At the end of 2017, ZhenFund invested in the first batch of decentralized exchanges. At the time, I was about to graduate and was making career decisions, so I naturally chose to stay in one of the exchanges. As one of the earliest employees, and the first intern aside from the founder, I learned a lot about the blockchain, cryptocurrency, and DeFi fields. I have tried many roles including recruitment, marketing, and product, which enabled me to gain a vast amount of experience.

In 2018, Crypto entered a bear market and I was still a novice to the clients and entrepreneurial projects. To gain a better understanding of decentralized exchange and its applications, I dedicated myself to self-study, peer exchanges, and work practice for more than half a year to truly understand and enter the industry. With my background in 36Kr, I began to write educational articles to evaluate the value of each project from an analyst’s perspective, particularly in the DeFi industry.

DODO Founders, Source: DODO

By 2019, after many ups and downs, I was conceiving my next entrepreneurial project and seeking partners. Because of my previous business background, I went to look for a former colleague with a technical background — he was among the earliest smart contract developers in China and was also looking to build his own product. His idea was to create a DEX that optimizes the Uniswap AMM model. After learning more about his ideas, we immediately hit it off.

In the spring of 2020, DODO was founded, followed by financing and launching products. It was a year of intense work.

Source: DODO

Moonshot Commons:

What are the development opportunities and risks in the DeFi field? How did you finally choose this direction to start a business?

Daidai:

The word DeFi appeared around October 2018.

Around October 2018, when everyone was paying attention to mining machines, mining, public chains, and exchanges, the DeFi circle was still very small, and largely dominated by foreign developers. I was one of the first batch of people in China to follow DeFi and was determined to continue writing articles to spread the word about this field. Through writing articles, I have gradually accumulated followers, and have become acquainted with many builders in the DeFi world.

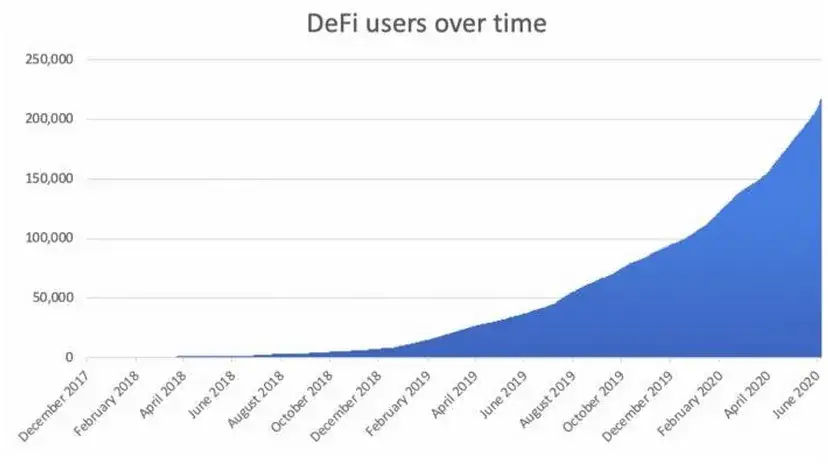

DeFi Users Over Time, Source: Dune Analytics

With the arrival of the bear market in 2019, we will find that the number of users who make dApps was actually very small, and the number of monthly active users was only in the hundreds. At that time, many entrepreneurs thought about giving up. OpenSea and Dune Analytics you see today have all struggled on the verge of giving up, but the difference is that the company I worked for actually gave up.

It was a real pity; those who persisted are now mostly unicorns or have opened up entire user markets like OpenSea.

After I had built up a certain level of influence in the DeFi circle by writing articles, I was approached by multiple companies wanting to poach me, but I chose to step away and explore other aspects of the Crypto field. It was then that I knew I was familiar with DeFi, but there were numerous other opportunities to explore, prompting me to establish my own PR company.

During that period, I came into contact with many public chain projects and gained a more comprehensive understanding of the technical trend of the Crypto field. It was also then that I realized, to really make an impact and reach a higher ceiling, I must have my own product. This led to me investing in the entrepreneurial venture DODO.

Of course, the process was far from smooth. We also had some bumps and turns during the initial fundraising phase, but overall things were going quite well for us. Because Uniswap was already a hit at the time, VCs wanted to invest in something similar. Our project, DODO, is based on Uniswap but with differentiated innovation. That made us stand out.

From this you can see that when you are on the hottest track, yet you are still innovating, you will be very popular with investors. Basically, the top Silicon Valley VCs or exchanges in Defi all invested in us. This inspiring story has motivated my peers, showing them that Chinese people can make strides and be recognized in this industry.

After us, more domestic entrepreneurs are willing to take entrepreneurial risks and pursue their own career achievements, which I find incredibly meaningful.

Moonshot Commons:

Compared with startups in the same field, what makes DODO special? How to maintain industry competitiveness?

Daidai:

As far as DODO is concerned, we have several different user groups.

For traders, DODO deploys multiple chains, each with its own aggregator, which utilizes our proprietary routing algorithm to find the best transaction prices across the entire network. With DODO, traders are able to buy and sell any type of encrypted assets, as well as provide liquidity to earn handling fees and conduct financial management activities.

For project parties, DODO offers a more cost-effective fundraising solution than Uniswap. Thanks to our optimized algorithm and comprehensive suite of tools, project parties don’t need to pledge funds as a starting point. They can choose to actively price tokens, set token prices, or adjust parameters with the depth of the pool to reduce their fundraising costs.

DODO Features, Source: CoinCodeCap

Different from market makers, DODO will deploy various strategies on DEX. Market makers will have the opportunity to create their own liquidity pools, manage their resources through arbitrage and hedging, and ultimately generate profit on the platform. At present, DODO and Uniswap V3 are the two go-to choices when it comes to DEXs.

In the future, DODO will always focus on the liquidity of “more, faster, better and more economical”, bringing more surprises to everyone.

Moonshot Commons:

Why didn’t you choose a more common path, but turned around to explore the Crypto industry?

Daidai:

Given the fact that many of Moonshot Mafia’s listeners are students who may be facing a difficult decision, I want to share with you my initial thoughts when faced with a choice.

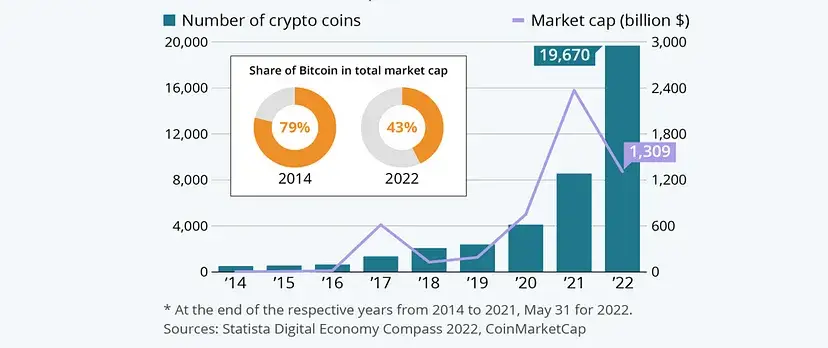

First of all, the world shaped by Crypto has a natural appeal to me from the underlying logic. From an investment point of view, Crypto is a blue ocean track, unlike the more saturated fields of finance, the Internet, and the media. The only thing you need to worry about is whether the track is actually viable and what the upper limit is.

Total Number of Cryptocurrencies & Market Capitalization (2014–2022), Source: Statista

My approach to this kind of problem is to remember that all industries have cycles, and I am willing to commit up to three years to go through the cycle in this new world. Even if I’m a “nobody” in the beginning, I will be able to make something of myself by the second cycle. That’s why I chose to join a small Blockchain startup instead of continuing my studies, going abroad, or entering another industry. I firmly joined a Blockchain entrepreneurial team with only three or four people.

Facts have proved that I made the right choice.

From entering the industry in late 2017 to establishing my own business in 2020, I have seen an abundance of change in the industry in the span of three years. Perhaps the simplest option may be the most prudent one in the present, yet you should be aware that the world is constantly evolving; thus, my advice is to be patient and give yourself time.

Moonshot Commons:

What are the characteristics of Crypto transactions? How is it combined with DODO’s business?

Daidai:

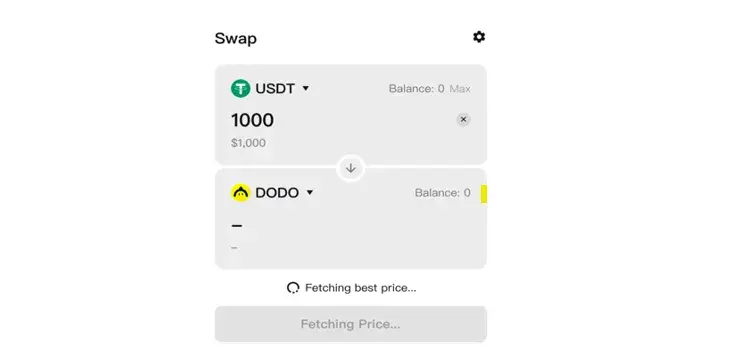

In the Crypto world, transactions must be the most frequent action, so Swap is a just-needed scene. CEX and DEX are places where a large number of transactions occur. If DEX is given a definition, it should be in three layers:

1.Liquidity layer — Who will price assets and how to ensure immediate transactions. CEX has market makers who continuously make markets on the orderbook, while DEX uses a mathematical formula to automatically complete transactions based on the inventory in the liquidity pool.

2.Routing layer — Assets in different pools are different in quality. In places with good liquidity, ETH is worth more USDC, and in places with poor liquidity, ETH is worth less USDC. Routing is used to calculate liquidity and give the best quotation.

3.User layer — The interface used by users, the core of this layer is to reduce user cost.

Using DODO to Swap, Source: DODO

Moonshot Commons:

What will the next generation of DEX look like? What do you think the endgame of the industry will look like?

Daidai:

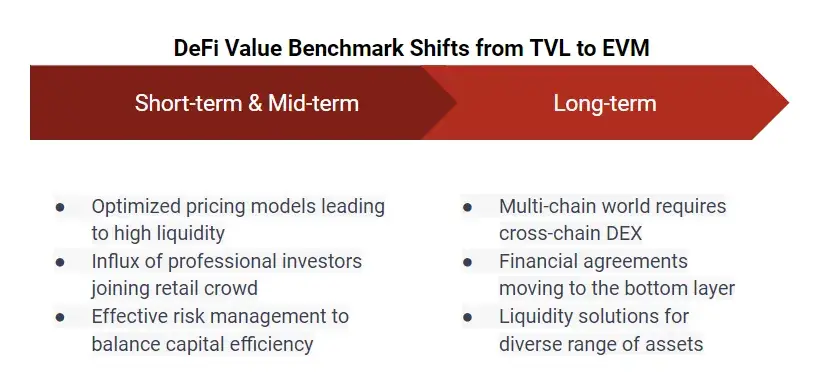

First of all, everyone now evaluates DeFi products from the perspective of TVL, but this is actually a very one-dimensional criterion for judging. First, even if there is no real product value, the falsely high APY (Annual Percentage Yield) can be maintained by continuously issuing coins; second, the users attracted by the falsely high APY are disloyal and not the real users of the protocol.

False prosperity is unsustainable, and the future development trend of DeFi must be that protocols with real value will gain a higher market value. Therefore, when judging the value, our benchmark will also shift from TVL to EVM, that is, it will actually operate in the protocol and provide effective capital lock-ups of real value for financial services such as trading and lending.

Source: Moonshot Commons

Based on this guiding ideology, the entire DeFi space needs to strive for greater capital efficiency, which could manifest in the following short- and mid-term trends:

1.At the algorithm level, after the underlying pricing model is optimized, funds will have relatively high liquidity;

2.An influx of professional investors to join the retail crowd;

3.Risk management and the balance between capital efficiency and risk exposure.

Looking further ahead, the DeFi space will see:

1.A multi-chain world must require a cross-chain DEX;

2.Scenario finance, financial agreements moving to the bottom layer and DeFi being integrated into the transactions and settlements of various products (e.g. props, assets);

3.Liquidity solutions for a diverse range of assets, such as financial derivatives of NFTs, lending based on social status, and DID credit.

Moonshot Commons:

How to make the applications and services in Crypto target more people? Why do ordinary people choose DODO?

Daidai:

My biggest feeling is that Crypto has a very strong inner vitality, and the wealth-creation effect is very obvious. In this world, the opportunity is not limited to a single generation or a single group of people, and this is the most attractive characteristic of crypto. For example, when I first came in, I was still an outsider, and the mainstream circle belonged to the bigwigs of BTC. Had they not recognized Ethereum, many of us would have missed out on great opportunities. The same goes for miners, who might have missed out on potentially lucrative IDO (Initial DEX Offering) opportunities, or those of us in the DeFi space who may not have seen the value in NFTs.

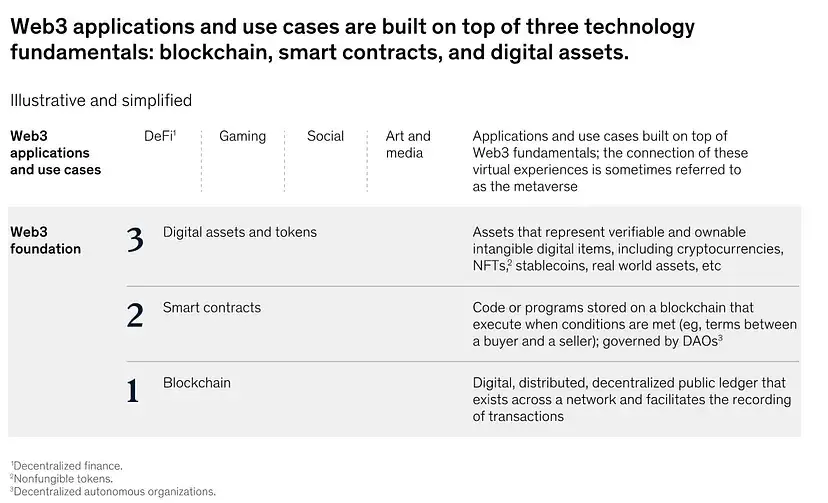

Web3 Applications and Use Cases, Source: McKinsey & Company

For those just starting out, it’s important to understand that participating in Web 3.0 financial games means dealing in assets — coins, tokens, and more. You can acquire these assets, sell them, or exchange them. This is the core of Crypto. There is a high probability that every product you play will issue coins or have already issued coins, then you can either get the assets yourself, sell them, or exchange the two assets.

It is a just-needed scene.

For ordinary users, in addition to your own daily activities, if you need to trade this action, you can also optimize your existing earnings. For example, the current economic environment is relatively complicated. When you allocate your own assets, you may have Chinese Yuan, US dollars, or even some bitcoins. Almost all financial products have certain options for you. If you replace the assets, you can stabilize the income of 10%~20% on the line.

This is the most rigid and basic user requirement.

Moonshot Commons:

DODO has been pursuing a remote office system. Do you have any thoughts or suggestions on this?

Daidai:

We have been working virtually since Day 1.

For entrepreneurship, after you have an idea, the most difficult thing is to find the right people. It is very difficult to find people who believe in you, who you trust, and who are capable all at the same time. All along, we insist on talent first, including those who work with us part-time. For this, many friends working part-time at that time chose to quit their previous jobs and joined us full-time.

Source: DODO

Another thing is, due to policy changes, we are facing certain risks in China when it comes to DEX. My partner could consider going abroad at any time, which would make us completely remote. In the beginning, remote work was a last resort decision for keeping talent, but we soon realized that a fully remote work environment could be incredibly attractive for recruitment. We have since maintained the remote working structure.

Collaboration Tools Adopted by DODO, Source: Google Images

Of course, for the team, remote work requires a lot of preparation. We have summed up some tips to share with you:

First, you need a good set of collaboration tools. We use Slack for daily communication, Zoom for meetings, Notion for long-term thinking and document retention, and Asana for task management. We make sure that everyone is working on these tools. This way, everyone can stay up-to-date with the progress of each project.

You also need to establish a meeting system with the team. Since remote work requires regular updates, we divided the team into 8 groups — 4 for product architecture and 4 for operations and marketing. We have a core team with the founder and team leaders that meets weekly, and each team leader and team members also have their own meeting schedules. The only rule is that whenever a meeting is held, an organizer must record and document all discussed ideas and issues.