IOSG Ventures is a pioneering crypto fund that invests in the future of Web3. As a thesis-driven firm, it assists founders in developing community-driven protocols that are primed to transform the crypto landscape. Its portfolio comprises a wide range of innovative and high-potential investments, including L1/L2 (Polkadot, NEAR, Starkware, Arbitrum), Security Auditing(Runtime Verification, Hexens), DeFi/NFT-Fi (1inch, 0x, Metamask), GameFi (Bigtime, Illuvium), and SocialFi (Galaxy, Cyberconnect). The IOSG team comprises experienced crypto-native BUIDLers and long-term HODLers, and it remains fully committed to supporting our early-stage developers and founders. Since its founding in 2017, it has invested in a number of industry leaders, including Arweave, Cosmos, Celestia, Eigenlayer, Scroll, zkSync, Nil Foundation, and Mina. Whether you’re building infra, middleware, Security, gaming, or social platforms, the IOSG team is passionate about investing in crypto-native paradigms that have the potential to transform the future of the industry. As the crypto market continues to grow and attract a high volume of investments, the importance of understanding investor strategies, gaining insight into market cycles, and making well-informed decisions is paramount. As new and innovative ideas emerge, the reliance on pre-existing templates is decreasing, and the emphasis on creating value through originality is increasing.

The crypto industry is marked by continuous fluctuations, with numerous projects rising and falling in line with market trends. Navigating this dynamic ever-changing landscape requires a long-term perspective and adherence to the principles of decentralization. Additionally, it necessitates the ability to weather market downturns and identify sustainable value within market cycles.

At Moonshot Commons’ Web3 Fireside Chat #7, we are honored to feature Queenie, Partner at IOSG Ventures, to provide her unique perspective on the ebbs and flows of the industry, the changes she has observed in the crypto market, and her vision for the future of the crypto world.

Key Takeaways:

1.Old Friends Reunion is an annual event hosted by IOSG Ventures to foster deeper connections and collective understanding. The themes for this year’s event focus on decentralization principles and sovereign individuals.

2.The Web3 ecosystem is driven by the United States, Europe, and Asia, each providing its own strengths.

3.Queenie has been involved in venture capital since 2017 and joined IOSG Ventures in 2018, focused on research-driven work and the long-term potential of decentralization.

4.IOSG implements a theme-driven approach to portfolio alignment and a “high frequency aggressive” investment style emphasizing Ethereum technology.

5.Web3 entrepreneurs must be open-minded and focus on long-term value to succeed in the ever-changing ecosystem.

“In the constantly evolving Web3 ecosystem, entrepreneurs must strike a . This requires a deep understanding of the industry and the ability to make strategic decisions that align with decentralization while adapting to the industry changes.”

OFR2022 — Sovereign Individual & ZK Odyssey. Source: @JinzhouLin. Moonshot Commons:

IOSG’s annual Old Friends Reunion event, titled Sovereign Individual & ZK Odyssey, concluded successfully this year. Looking at past event topics is like seeing the evolution of the whole Web3 industry. What was the inspiration behind this year’s theme?

Queenie:

Old Friends Reunion is a large annual event held by IOSG every year. It is not so much a formal meeting as it is a gathering of old friends.

Founded in 2017, IOSG Ventures is a research-driven early-stage crypto fund. By bringing together a diverse group of projects and partners, the Old Friends Reunion provides an opportunity to discuss the successes, challenges, and current state of the industry. This includes an examination of potential breakthroughs and an open dialogue on how to support and collaborate to continue building a strong and thriving ecosystem. The goal is to foster deeper connections and collective understanding, to better navigate the industry and capitalize on its potential.

The Old Friends Reunion serves as a platform for fostering closer communication and thought-provoking interactions. We aim to provide inspiration and motivation. The theme for each year is determined based on the most relevant topic of the year. This year’s theme — “Sovereign Individual and ZK Odyssey” — the two components are seemingly separate but closely linked.

The concept of the Sovereign Individual originates from the work of James Dale Davidson and William Rees-Mogg, published in 1997, who summarized the changes in social civilization from the agricultural revolution and industrial age to the information network and the social problems at each stage from various perspectives of sociology and anthropology. They predicted that information technology will accelerate human civilization to a more complex social form, which implies the possibility that individuals can embrace more sovereignty. This book may have influenced some of the practitioners in the crypto world because the author’s philosophy has a high overlap with what we now call the spirit of crypto.

This year’s theme, “Sovereign Individual & ZK Odyssey,” aims to remind practitioners of their original intentions and encourage them to re-evaluate the value their products can bring to the industry, individuals, and society amidst industry challenges. The sub-theme of ZK Odyssey highlights the potential of zero-knowledge proof technology for privacy and expansion as a powerful tool for the personal sovereign economy. We aim to gather and exchange ideas with talented individuals in the field to provide inspiration and direction.

As we anticipate new applications’ emergence, we continue to explore ways to promote them.

OFR2022. Source: @IOSGVC. Moonshot Commons:

Having traveled to many countries and cities in Asia, New York, Tokyo, San Francisco, etc, what does it feel like to present the Old Friends Reunion to the world?

Queenie:

When we first organized the Old Friends Reunion, we intended to establish a stage in China and invite practitioners and friends from various industries to come and meet community members in China and other countries in Asia, acting as a bridge for communication between the East and the West. Later, we also expanded our reach and brought our Asian practitioners to the West. This is the first time we came to Europe.

Although IOSG originated in Asia, we have always had a global focus on the encryption market, with 80% of our portfolio in Europe and the United States. This gathering of old friends is a rare opportunity to bring our overseas portfolio together and showcase our vision, past investment concepts, and achievements to the European community. We are confident that we can better support developers and entrepreneurs abroad, especially in Lisbon, which is now a crypto hub in Europe.

Lisbon offers a unique crypto atmosphere with free mobility, not just for personal assets but also for practitioners. The freedom and flexibility of remote and friendly working methods allow crypto practitioners to be spread all over the world. We also plan to set up a new office in Europe, most likely in Lisbon, to serve as a stop-and-visit point for everyone on the move.

Moonshot Commons:

Based on years of experience in the industry, what do you think are the differences between Chinese and foreign Web3 ecosystems?

Queenie:

Overall, the U.S. has the leading overall strength and the most extensive research and development system. This is not only reflected in the ability to build infrastructure but also in the strong academic resources that are driving the breakthrough of encryption technology. It is also a major capital base, which attracts many mainstream projects, including those in our portfolio. However, practitioners in the United States also face significant regulatory pressure and uncertain challenges.

Europe places great importance on computer science and cryptography education and has a wealth of developer resources. European projects tend to focus on infrastructure and have a more methodical approach, with teams working diligently in the technical field. In recent years, more high-quality projects have emerged from Europe.

As an important player in the crypto field, Asia has its own unique strengths, despite facing different regulatory policies and market forms across different markets. The potential for application popularization in the Asian market should not be underestimated. Asia has a strong product experience, a large user base, and technical capabilities comparable to those of Europe and the United States. Entrepreneurs in Asia should focus on fully utilizing the advantages of encryption technology to create unprecedented new products.

“The path I am optimistic about is to guide users directly to Web3 instead of just spinning around in Web2.”

Moonshot Commons:

How did you get into Web3 in the first place?

Queenie:

In 2017, I was first introduced to blockchain-related projects at a traditional venture capital. I was immediately captivated by the potential of this technology. I believe that the development of all things follows a cycle, and technology is no exception. The cyclical evolution of technology is closely tied to the development of society and human civilization. The original intent of the internet was to create a decentralized, peer-to-peer network, but what we have seen so far is the domination of Web2 by a few large players. This presents an opportunity for blockchain and encryption technology to reshape the internet, potentially bringing about a technological revolution and having a profound impact on social collaboration, economic systems, and human civilization. This could be seen as a continuation of Web2, or a return to Web1. This potential excites me, and I am eager to be a part of it.

My official journey into Web3 began in 2018 when I joined imToken. At that time, I had the opportunity to work with an experienced team for four years, and slowly developed my understanding of the industry. imToken is one of the earliest non-custodial wallets in the industry and a respected pioneer. From the very beginning, imToken has been dedicated to the attributes of decentralization, permissionlessness, and trustlessness, and has worked hard to build its first product.

Throughout this process, we have all witnessed the achievements made by the team, the love they have received from users, and the growth they have achieved. In the constantly evolving world of Web3, building decentralized products requires understanding how to resist temptations and staying true to the concept of decentralization.

As a wallet and major portal, the team often faces many strategic choices, and there are many short-term benefits and temptations to consider. However, imToken has always stayed true to its philosophy, prioritizing user asset safety, and working to achieve the best user experience based on decentralization, all while supporting other projects in the industry.

Being in charge of investments at imToken has been an incredibly valuable experience for me, and it has been a journey from zero to one. Through investment, we have been able to lay out the future of imToken, make connections with like-minded individuals, better empower the ecosystem and product experience of the wallet, and achieve both financial and strategic benefits. It has been a step-by-step exploration, and I am proud of the progress we have made.

Managing investments at imToken has been a highly valuable experience for me, both personally and professionally. By strategically shaping the future of imToken through investments, I have formed strong relationships with like-minded individuals and empowered the ecosystem and user experience of the wallet. I have also been able to achieve financial and strategic success. It has been a journey of continuous exploration and refinement. I am proud of the progress we’ve made and the results we’ve achieved.

Ethereum and Bitcoin Blockchain Wallets. Source: @imTokenOfficial. Moonshot Commons:

Why did you choose to join IOSG at that time? In your view, what is the difference between IOSG and other investment institutions?

Queenie:

My decision to stay in venture capital after leaving imToken was driven by my deep passion for the field and my commitment to it since the start of my career. My ambition is to specialize in a specific area, to constantly improve and push past my own limitations, manage larger funds, form an outstanding and well-rounded team, and provide exceptional value to standout entrepreneurs in the industry.

I joined IOSG because our visions align.

First, our investment philosophy is aligned as we both believe in the long-term potential of decentralization, which has enabled us to avoid potential pitfalls and disruptions and maintain a clear and certain understanding of our ultimate goal.

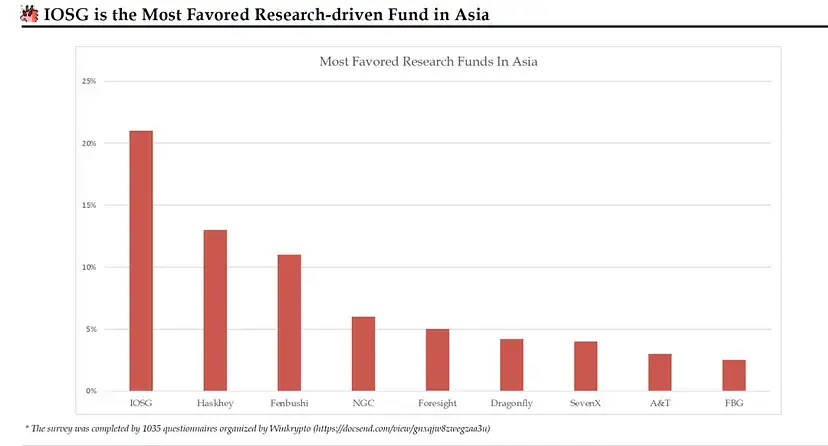

Second, we prioritize research-driven work, which is crucial in such a rapidly evolving industry. This approach allows us to have a deep understanding of the industry’s pulse, as well as a thorough comprehension of project fundamentals, team structure, and quality, and to identify what can be achieved. IOSG is one of the few funds that consistently publishes research insights and its high-frequency writing has established it as a “go-to” for Asian DeFi funds. Despite its room for improvement, I believe the team is young, exceptional, and has deep research and expertise in their respective fields. They trust and support each other and have great potential.

IOSG has been named the top-rated research-driven fund in Asia. Source: IOSG Ventures. IOSG’s team of investment researchers comprises 13 individuals with diverse technical and product backgrounds from around the world. Adopting a theme-driven investment approach, the company has been able to consistently align its portfolio with the evolving narrative of the encryption industry over the past five years, transitioning from L1 to L2, multi-chain to zk-EVM, and modular blockchain to middleware protocols and data indexing, ultimately shifting focus to application-oriented projects. Moonshot Commons:

IOSG mentioned at the beginning of the year that “our main focus areas this year include layer-two scaling, DeFi, GameFi, and SocialFi”, has the direction of IOSG’s focus changed in the past few months? And what trends are you seeing in these industries?

Queenie:

At IOSG, we prioritize both the infrastructure and application tracks. While we have previously placed more emphasis on infrastructure, we have allocated almost 80% of our capital toward the infrastructure track of the crypto industry over the past five years. Our long-term commitment to this track has led us to invest in numerous infrastructure head projects, such as Polkadot, Cosmos, Near, Avalabs, and Mina, among others. It is one of IOSG’s strongest areas of focus.

An example of this is our early investment in Near Protocol, a project founded by one of the authors of the revolutionary AI paper “Transformers and Large Language Models” in 2017. However, as the infrastructure matures, we are now shifting our focus toward applications. Our future portfolio is expected to have a balance of 50–60% for infrastructure and 40–50% for application.

Next, I will share a few aspects of Infra:

1.Improving user experience through core technology: This includes solutions for scalability such as Layer 2 (e.g. Starkware, Arbitrum, Aztec, Scroll) and Layer 3, cross-chain solutions, mining extractable value (MEV), and wallets.

2.Data middleware: Blockchain is a decentralized ledger that allows for open and transparent information. Web3’s focus on data ownership can be achieved through the increasing number of applications on the chain and the growing scale of data. However, searching, determining value, and building a decentralized system that ensures user ownership and benefits is a significant challenge. Current data analysis platforms and tools often operate in a centralized manner, leaving room for disruption. We see opportunities in Data Infra, particularly in fields such as risk modeling and AI machine learning.

3.Privacy computing applications such as Zero-Knowledge Proof: The current innovations brought by Zero-Knowledge Proof are mainly in scalability and privacy. Currently, Zero-Knowledge Proof is mostly used in Ethereum’s Layer 2, but the application of privacy computing has a lot of potentials to expand to other areas. Privacy applications are still in the early stages, leaving many new opportunities to explore.

Moonshot Commons:

Specific to the three types of applications: DeFi, GameFi, and SocialFi, which direction do you think will have greater opportunities?

Queenie:

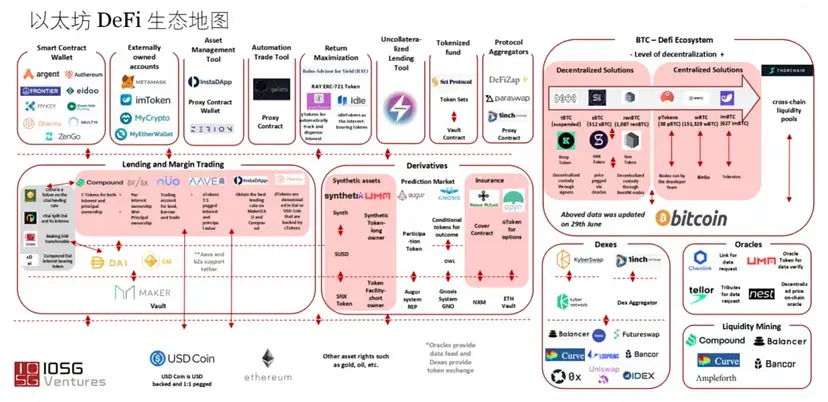

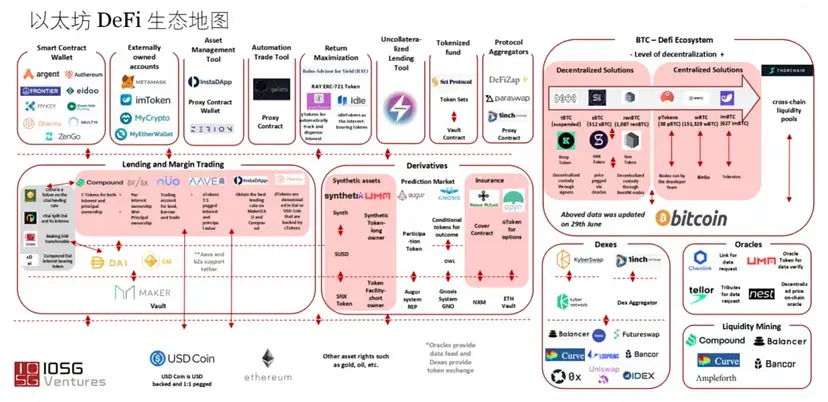

DeFi, GameFi, and SocialFi are all promising directions in the blockchain space. Specifically, DeFi offers a fully operational financial system on the chain, where user assets can flow more efficiently under a decentralized system and provide financial activities with no approval and low barriers to entry. Despite some claiming that DeFi is dead, I believe there are still opportunities for innovation in areas such as capital utilization and user-friendly solutions. For example, IOSG invested in MakerDAO in 2017 and saw potential in DeFi unicorns like Metamask, 1inch, Matcha, and 0x before the DeFi summer of 2020.

In my opinion, the gaming sector may have been overhyped in the past year. While it is widely acknowledged that it has the lowest barriers to entry and is a great way to introduce users to Web3, I believe that many of these games simply copy the logic of Web2 and add NFT or tokens to it, rather than truly embracing the possibilities of Web3. I am particularly interested in on-chain gaming, where all the game logic is on the blockchain and can be reproduced and derived without permission. Players become part of the game creator and there is a complete economic system that can run automatically and indefinitely. Additionally, the concept of the metaverse is often thought of as a separate game system, but I see the current on-chain world as a prototype for the metaverse, where behavior and content on the chain are the building blocks.

In addition to gaming, I see great potential for innovative Web3 social systems. In Web2, social platforms control user data, manage social interactions, and profit from user data. Web3 aims to return control of social interactions and data back to users, giving them more control and privacy. The breakthrough for Web3 social networks will come from new scenarios, and on-chain gaming may be one such scenario for forming new social relationships.

Overall, I believe the path to success in Web3 lies in guiding users directly to web3, rather than simply expanding on Web2.

“Often, a small and seemingly insignificant function can evolve into a powerful and versatile tool.”

Moonshot Commons:

Up to this point, IOSG has invested in over 100 projects. What investment strategies have the IOSG partners implemented to contribute to and influence the growth of the Web3 ecosystem?

Queenie:

Jocy Lin, the founding partner of IOSG, called IOSG’s investment style “high frequency aggressive”. High frequency refers to intense research and action (such as interacting with developers on prospective projects); “radical” refers to the boldness to conduct research and iterate one’s own strategy in directions that others may not be willing to take. By doing so, IOSG has been able to participate in many cutting-edge projects in the cycle of application explosion.

One of the defining features of IOSG is its Ethereum-first investment strategy, which is designed to take full advantage of the Ethereum technology stack. As a result, Ethereum developers are at the forefront of Web3 development, making up one-fifth of all Web3 developers. Moreover, the Ethereum Virtual Machine (EVM) is the most widely used blockchain platform among developers, thanks to its robust technology and large developer community.

In 2020, IOSG made a surprise move by investing in the gaming sector, with the intention of hedging against the potential downside of the DeFi market. To this end, they chose to invest in two of the most popular 3A game platforms of the time: Illuvium and Big Time Studio. Both have since gone on to show significant growth; Big Time Studio’s Discord community boasts over 400,000 users, while Illuvium has expanded its offerings to include fantasy battle and role-playing games, land sales, and auto chess and card games.

Big Time Studios. Source: Big Time Studio. Moonshot Commons:

From traditional VC to Web3, what is the change in investment logic?

Queenie:

To succeed in the Web 3.0 era, it is essential to have a strong grasp of technology as well as an imagination to envision the potential of blockchain technology.

Blockchain technology provides a decentralized, permissionless, trustless, and transparent ledger, which, when combined with tokens, can create new application models. To understand a project’s potential value, it is essential to assess the features of blockchain technology that it uses and how they unlock its potential. The infrastructure of this industry is continuously evolving and only a comprehensive understanding of its components can accurately identify potential opportunities. Furthermore, most of the founders in the blockchain industry have a technical background, making it difficult to engage in an effective conversation and gain recognition without a thorough understanding of the technology.

I think blockchain investing requires a lot of imagination. We are investing in ideas that come out of the blue, innovations that have no precedent in Web2, and applications that are being transformed from Web2 to Web3 that have not been developed very well. There is a huge first-mover advantage in this industry, so when we come across projects with innovative features, we are eager to explore all the possibilities further.

Moonshot Commons:

We saw that IOSG established a Kickstarter Program to provide assistance to early entrepreneurs. This was a rather rare initiative in the Asia-Pacific region, and it raises the question: what motivated IOSG to open such a project?

Queenie:

Our primary goal in launching the Kickstarter Program was to support individual entrepreneurs and developers who possess expertise in their respective fields but lack the resources in the early stages of their projects. We noticed that these individuals often have limited resources, no team, and incomplete ideas. With the help of this program, we aim to provide them with the necessary resources to succeed.

Under such challenging circumstances, it can be difficult for us as a fund to make investments due to the high-risk factor. Nonetheless, as supporters of the industry, we want to provide more help to such outstanding entrepreneurs and developers, not just financial support, but also comprehensive guidance from mentors and relationship networks to explore technologies, financing, and business models. Since its establishment, we have supported around ten ultra-early-stage teams. We are now also thinking about how to make the project more systematic, more influential, and even more decentralized, and hope that interested partners can join in and keep the momentum going.

Kickstarter Program. Source: IOSGVC. Moonshot Commons:

What characterizes the entrepreneurs supported by IOSG?

Queenie:

IOSG-supported entrepreneurs are typically highly motivated individuals who possess a unique combination of technical expertise and idealism. They understand the power of technology to create meaningful change and have the tenacity to pursue their vision with perseverance. These founders have a deep understanding of their chosen technological field and often have a knack for taking small features and turning them into powerful, general-purpose tools. Additionally, they often have strong connections with the developer community, which can be a great asset when it comes to finding resources and building a network.

But such entrepreneurs are often too deep in the swamp of technology, ignoring the needs of the market and users, and facing challenges in management and commercialization as the project gradually expands.

Moonshot Commons:

Many people take the VC movement as the beacon of the industry, thinking that they are the shapers of the future. Do you have a sense of this kind of social responsibility? How do you view the role of investors in the Web3 ecosystem?

Queenie:

Entrepreneurs and developers in the industry are the shapers of the future, while venture capitalists (VCs) provide support and acceleration in the later stage. For this industry to develop sustainably, technology should be the primary driver, not capital. Traditional VCs often utilize a “wind-making outlets” model, where they identify a replicable model and use money and personnel to quickly mature it, and then spread it out. We have seen this with some “Capital Bureau” public chain projects in Web3. Such an ecosystem is not sustainable, as participants lack the technology of faith and loyalty.

To achieve a healthy relationship, everyone should be a part of the building process, albeit using different methods. VCs should consider the value they can provide in addition to capital. This technology can bring positive value to at least some people and fulfills some social responsibilities if the story of Web3 becomes a reality. For this to happen, entrepreneurs and VCs must be open-minded and focus on long-term value.