Back

Arbitrage

DeFi

By HackQuest

Jul 19,20243 min readWelcome to the Web3 world, where cryptocurrencies, blockchain, and a unique culture converge. Entering the world of Web3 can be both thrilling and overwhelming, especially when faced with the seemingly cryptic language used by enthusiasts. Don't worry if you feel they sound like some secret codes; we are here to unravel their meaning in Web3 context. In this article, we are going to introduce: [Arbitrage].

What Does 'Arbitrage' Mean?

In the context of Web3, Arbitrage refers to the practice of taking advantage of price differences between two or more markets. Traders buy an asset at a lower price in one market and sell it at a higher price in another, thereby making a profit from the discrepancy. This concept is not new and has been a fundamental part of traditional finance for centuries. However, in the decentralized and fast-paced world of Web3, arbitrage opportunities are more frequent and can be more complex due to the variety of digital assets and trading platforms available.

Source: Youhodler

Origins of Arbitrage

The concept of arbitrage dates back to the earliest days of trading and financial markets. In traditional finance, arbitrage opportunities arise when there are discrepancies in the price of an asset across different exchanges or markets. Traders exploit these discrepancies to make a profit with minimal risk. In the context of Web3 and cryptocurrencies, arbitrage has become more sophisticated, leveraging the unique characteristics of decentralized exchanges (DEXs), automated market makers (AMMs), and the rapid pace of the crypto markets.

How Arbitrage Works in Web3

Cross-Exchange Arbitrage

Basic Description: This involves buying a cryptocurrency on one exchange where the price is lower and selling it on another exchange where the price is higher.

Examples: A trader notices that Bitcoin is priced at $40,000 on Exchange A and $40,200 on Exchange B. They buy Bitcoin on Exchange A and sell it on Exchange B, making a profit of $200 per Bitcoin minus transaction fees.

Advantages: Potential for quick profits with minimal risk if executed correctly. Helps in price correction across markets, enhancing market efficiency.

Challenges: Requires fast execution to take advantage of fleeting opportunities. Transaction fees and withdrawal/deposit times can erode profits.

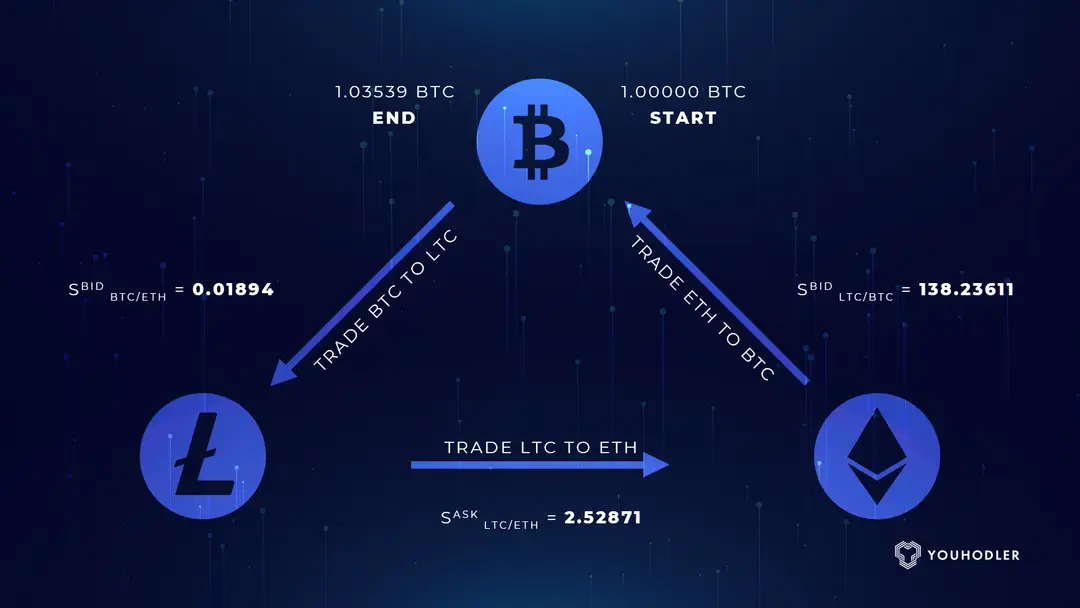

Triangular Arbitrage

Basic Description: This involves trading between three different cryptocurrencies to take advantage of discrepancies in their relative values.

Examples: A trader starts with Bitcoin, trades it for Ethereum, then trades Ethereum for Ripple, and finally trades Ripple back to Bitcoin, ending up with more Bitcoin than they started with due to price differences.

Advantages: Can exploit pricing inefficiencies within a single exchange. Doesn’t require moving assets across exchanges, reducing transfer times and fees.

Challenges: Requires precise calculations and quick execution. Transaction fees can still be significant, and opportunities are often short-lived.

DeFi Arbitrage

Basic Description: Leveraging decentralized finance (DeFi) platforms and protocols to find arbitrage opportunities, such as using flash loans to exploit price differences without needing upfront capital.

Examples: A trader uses a flash loan to borrow Ethereum, swaps it for a token on a decentralized exchange where it’s undervalued, sells the token on another platform for a higher price, repays the loan, and keeps the profit.

Advantages: High potential returns and doesn’t require large initial capital. Can leverage smart contracts to automate trades.

Challenges: High complexity and risk, especially if the market moves against the trader during the transaction. Requires in-depth knowledge of DeFi protocols and smart contracts.

Source: BingX Blog

Challenges and Future Directions

While arbitrage offers opportunities for profit, it is not without challenges. One major issue is the competition among traders, which can quickly erode profit margins as more participants try to exploit the same opportunities. Additionally, the costs associated with transactions, including fees and slippage, can significantly impact profitability.

In the future, arbitrage strategies are likely to become more sophisticated with the use of advanced algorithms and artificial intelligence. As the DeFi space continues to grow, new arbitrage opportunities will emerge, particularly with the increasing number of decentralized exchanges and financial products. Enhanced interoperability between different blockchain networks will also play a crucial role in creating and exploiting arbitrage opportunities.

Conclusion

Arbitrage is a vital concept in the Web3 ecosystem, offering traders opportunities to profit from price discrepancies across different markets and platforms. By understanding how arbitrage works and the various strategies involved, traders can effectively navigate the dynamic world of decentralized finance.