BaristaNet

Baristanet is a unified liquidity layer powering cross-chain intent-based execution - "Let Solvers Solve. Collateral in one place. Borrow anywhere. No rebalancing required.".

Videos

Description

☕️ Baristanet + 🍬 Caramel Swap

Let Solvers Solve. We Handle the Liquidity.

Website Link: Baristanet

Overview

Baristanet is a unified liquidity layer powering cross-chain intent-based execution. It allows solvers to post collateral once and borrow ETH across chains without rebalancing.

To showcase Baristanet in action, we built Caramel Swap — a cross-chain, open-intent-based token swap dApp that uses Baristanet as its liquidity backend.

💡 Problem

Cross-chain solvers today face:

Fragmented liquidity

Manual rebalancing/bridging

High barrier to entry

Capital inefficiency

✅ Baristanet: The Liquidity Engine

Baristanet abstracts away capital management for solvers:

Deposit once → Borrow anywhere → Solve without rebalancing.

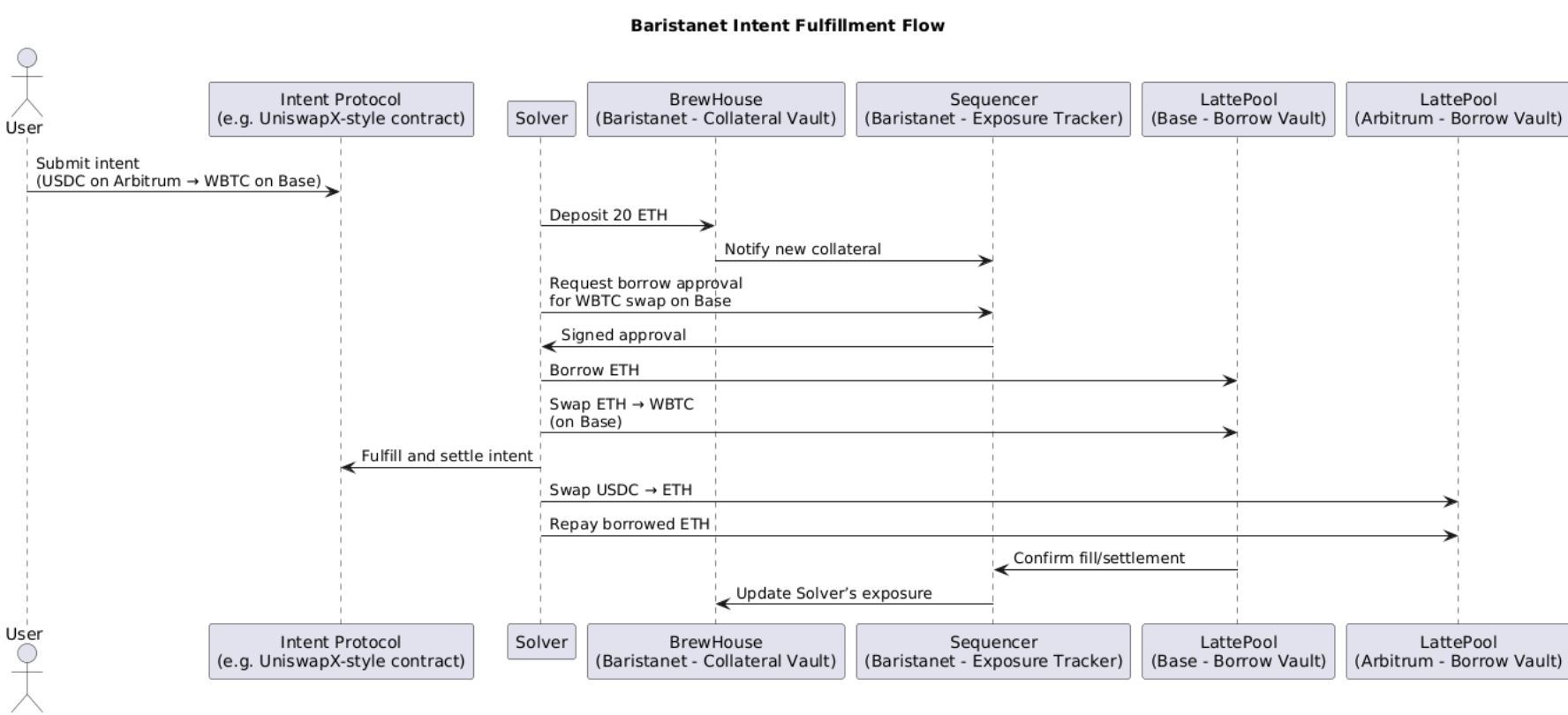

🔁 How Baristanet Works

Solver deposits ETH into BrewHouse (collateral vault)

User submits an intent (e.g.,

USDC on Arbitrum → WBTC on Base)Solver requests borrow approval for ETH on Base

Sequencer signs the approval

Solver borrows ETH from LattePool on Base

Solver swaps ETH → WBTC → fills the intent

User sends USDC on Arbitrum

Solver swaps USDC → ETH → repays borrowed ETH

Sequencer updates exposure and confirms settlement

🧱 Protocol Components

Component | Role |

|---|---|

BrewHouse | Vault for solver collateral |

LattePool | Lending vault on each execution chain |

Sequencer | Signs approvals, tracks exposure |

🧠 What is Open Intent & ERC-7683?

ERC-7683 defines a standard for intent-based execution, where users express "what" they want — not "how" to do it.

In an open intent model, users submit desired outcomes (like a token swap or cross-chain transfer) without specifying a path.

Solvers compete to fulfill these intents in the most efficient way, often across chains.

This decouples execution logic from the user, enabling:

Gasless transactions

Cross-chain execution

Solver-based competition

Greater UX simplicity

Baristanet is built to support this new paradigm — providing the liquidity layer that solvers rely on to execute intents quickly and capital-efficiently.

🍬 Caramel Swap

Caramel Swap is a demo dApp that enables users to perform open-intent-based cross-chain swaps, powered entirely by Baristanet liquidity.

🔄 How Caramel Swap Works

User submits an open swap intent (e.g.,

USDC → WBTC across chains)Solver watches the intent, then:

Borrows ETH via Baristanet

Swaps ETH to WBTC (on target chain)

Fulfills the user’s intent

User sends the source token (e.g., USDC)

Solver repays ETH debt using the received USDC

Caramel Swap demonstrates how intent protocols can decouple execution and liquidity while enabling gasless, cross-chain trading for users.

💰 Revenue Model

Borrow fees from solvers

Clearing & settlement fees

Interest spread for LPs

🌐 Why It Matters

As ERC-7683 and intent-based protocols grow, solvers need frictionless access to liquidity.

Baristanet empowers them — and Caramel Swap proves what's possible.

Let Solvers Solve.

Collateral in one place.

Borrow anywhere.

No rebalancing required.

Progress During Hackathon

100%

Tech Stack

Fundraising Status

Open For Further Discussion