Arbnomo

The first on-chain binary options trading dapp on Blockchain

Videos

Tech Stack

Description

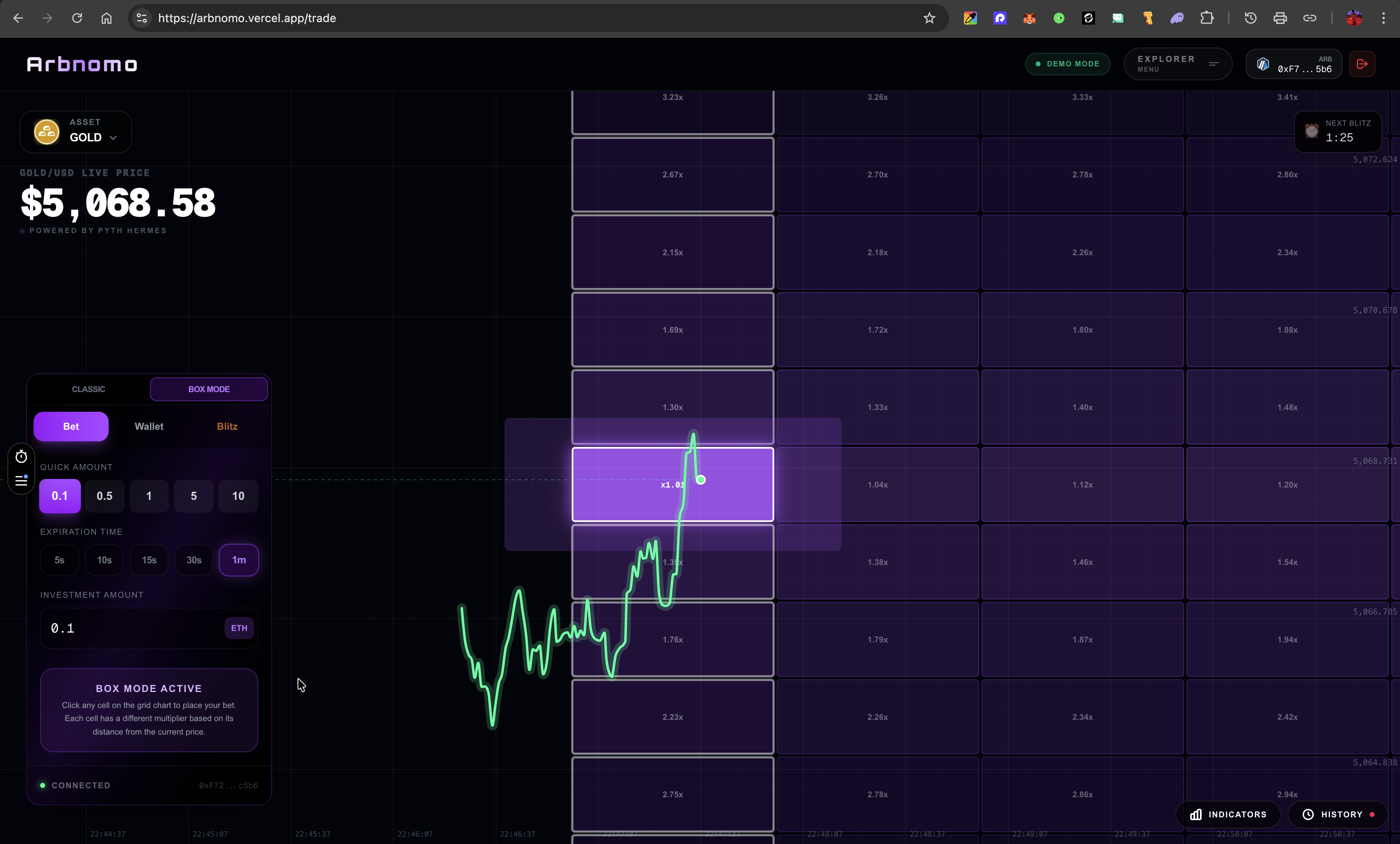

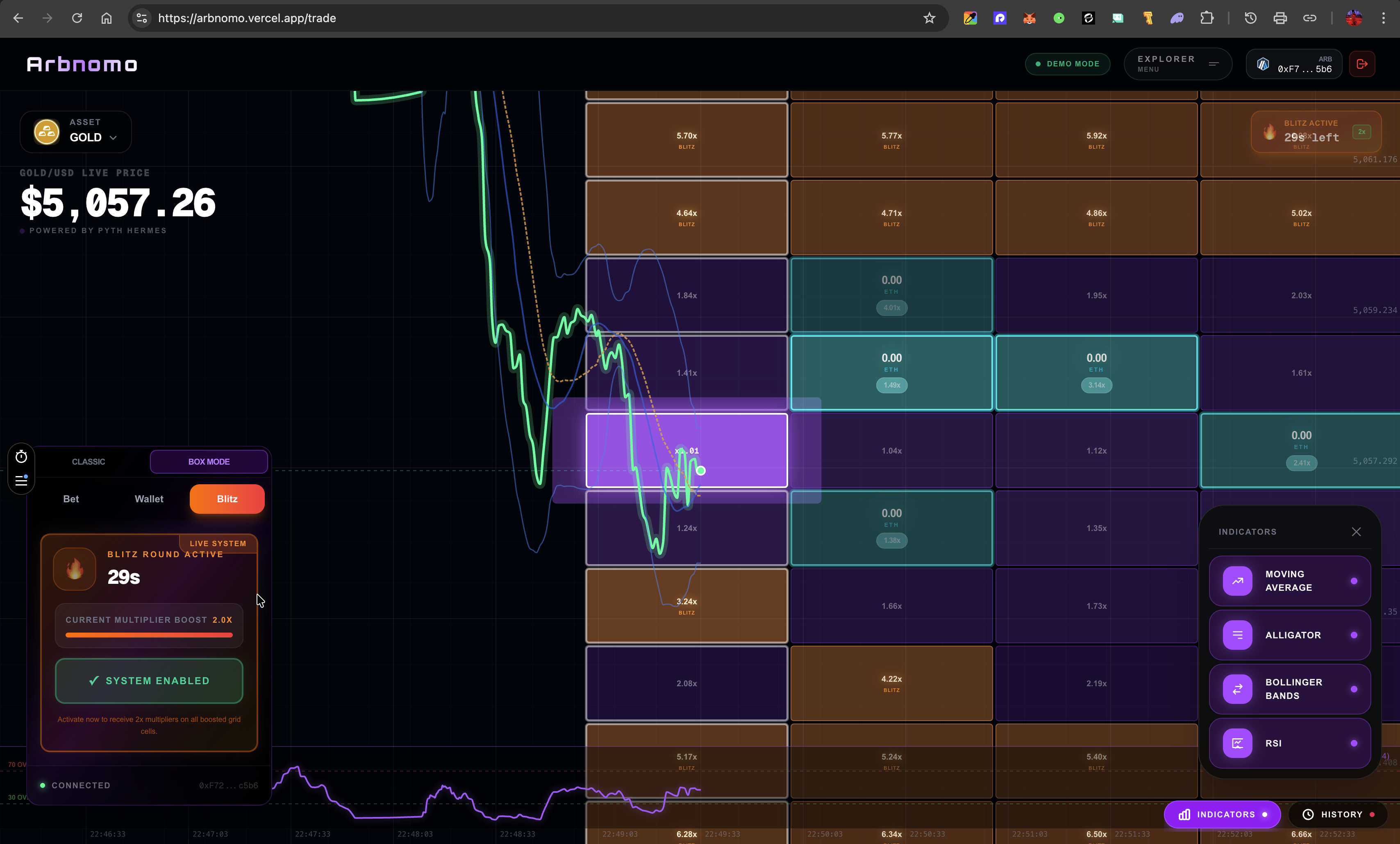

The first on-chain binary options trading dApp on Arbitrum Sepolia.

Running on Arbitrum Sepolia.

Powered by Arbitrum Sepolia + Pyth Hermes price attestations + Supabase + instant house balance x402.

Trade binary options with oracle-bound resolution and minimal trust.

Treasury Wallet (Arbitrum Sepolia): 0x83CC763c3D80906B62e79c0b5D9Ab87C3D4D1646

Why Arbnomo?

Binary options trading in Web3 is rare. Real-time oracles and sub-second resolution have been the missing piece.

Pyth Hermes delivers millisecond-grade prices for 300+ assets (crypto, stocks, metals, forex).

Arbitrum Sepolia — low fees and fast finality for deposits and withdrawals.

House balance — place unlimited bets without signing a transaction every time; only deposit/withdraw hit the chain.

5s, 10s, 15s, 30s, 1m rounds with oracle-bound settlement.

Arbnomo brings binary options to Arbitrum Sepolia with transparent, on-chain settlement.

Tech Stack

Layer | Technology |

|---|---|

Frontend | Next.js 16, React 19, TypeScript, Tailwind CSS, Zustand, Recharts |

Blockchain | Arbitrum Sepolia, ethers.js, viem, Wagmi, ConnectKit, Privy |

Oracle | Pyth Network Hermes (real-time prices) |

Backend | Next.js API Routes, Supabase (PostgreSQL) |

Payments | ETH native transfers on Arbitrum Sepolia, single treasury |

Market Opportunity

Metric | Value |

|---|---|

Binary options / prediction (TAM) | $27.56B (2025) → ~$116B by 2034 (19.8% CAGR) |

Crypto prediction markets | $45B+ annual volume (Polymarket, Kalshi, on-chain) |

Crypto derivatives volume | $86T+ annually (2025) |

Crypto users | 590M+ worldwide |

Competitive Landscape

Segment | Examples | Limitation vs Arbnomo |

|---|---|---|

Web2 binary options | Binomo, IQ Option, Quotex | Opaque pricing, no on-chain settlement; users do not custody funds. |

Crypto prediction markets | Polymarket, Kalshi, Azuro | Event/outcome markets (e.g. "Will X happen?"), not sub-minute price binary options; resolution in hours or days. |

Crypto derivatives (CEX) | Binance Futures, Bybit, OKX | Leveraged perps and positions; not short-duration binary options (5s–1m) with oracle-bound resolution. |

On-chain options / DeFi | Dopex, Lyra, Premia | Standard options (calls/puts), complex UX; no simple "price up/down in 30s" binary product. Lack of modes. |

Arbitrum Sepolia binary options | — | No on-chain binary options dApp; Arbnomo fills this gap. |

Arbnomo's differentiation: On-chain binary options on Arbitrum Sepolia with sub-second oracle resolution (Pyth Hermes), house balance for instant bets, and dual modes (Classic + Box) in one treasury.

Future

Endless possibilities across:

Stocks, Forex — Expand beyond crypto into traditional markets via oracles.

Options — Standard options (calls/puts) on top of the same infrastructure.

Derivatives & Futures — More products for advanced traders.

DEX — Deeper DeFi integration and on-chain liquidity.

Ultimate objective: To become the next Polymarket for binary options in the World.

Progress During Hackathon

Frontend, Contracts.

Fundraising Status

Just built this, not raised any, looking to raise now.