Crediflex is an Undercollateralized Lending Protocol powered by AVS and zkTLS, designed to improve capital efficiency in decentralized finance (DeFi)

Crediflex is an Undercollateralized Lending Protocol that introduces a novel approach to borrowing assets in decentralized finance (DeFi). By leveraging on-chain activity-based credit scoring, it enables users to borrow more assets than they collateralize, provided certain requirements are met.

Traditional lending protocols in DeFi face a significant limitation:

Overcollateralization Requirement: Users must deposit more collateral than the amount they intend to borrow.

This restrictive model limits capital efficiency and discourages broader adoption of lending platforms.

Crediflex addresses this issue with an undercollateralized approach, allowing users to borrow assets with collateral worth less than the borrowed amount. The key innovation lies in the integration of on-chain credit scoring to determine dynamic loan-to-value (LTV) ratios.

Crediflex is an undercollateralized lending protocol that leverages AVS (Autonomous Verifiable Service) with EigenLayer middleware to verify credit scoring and zkTLS to fetch proofed data for calculating C Score parameters.

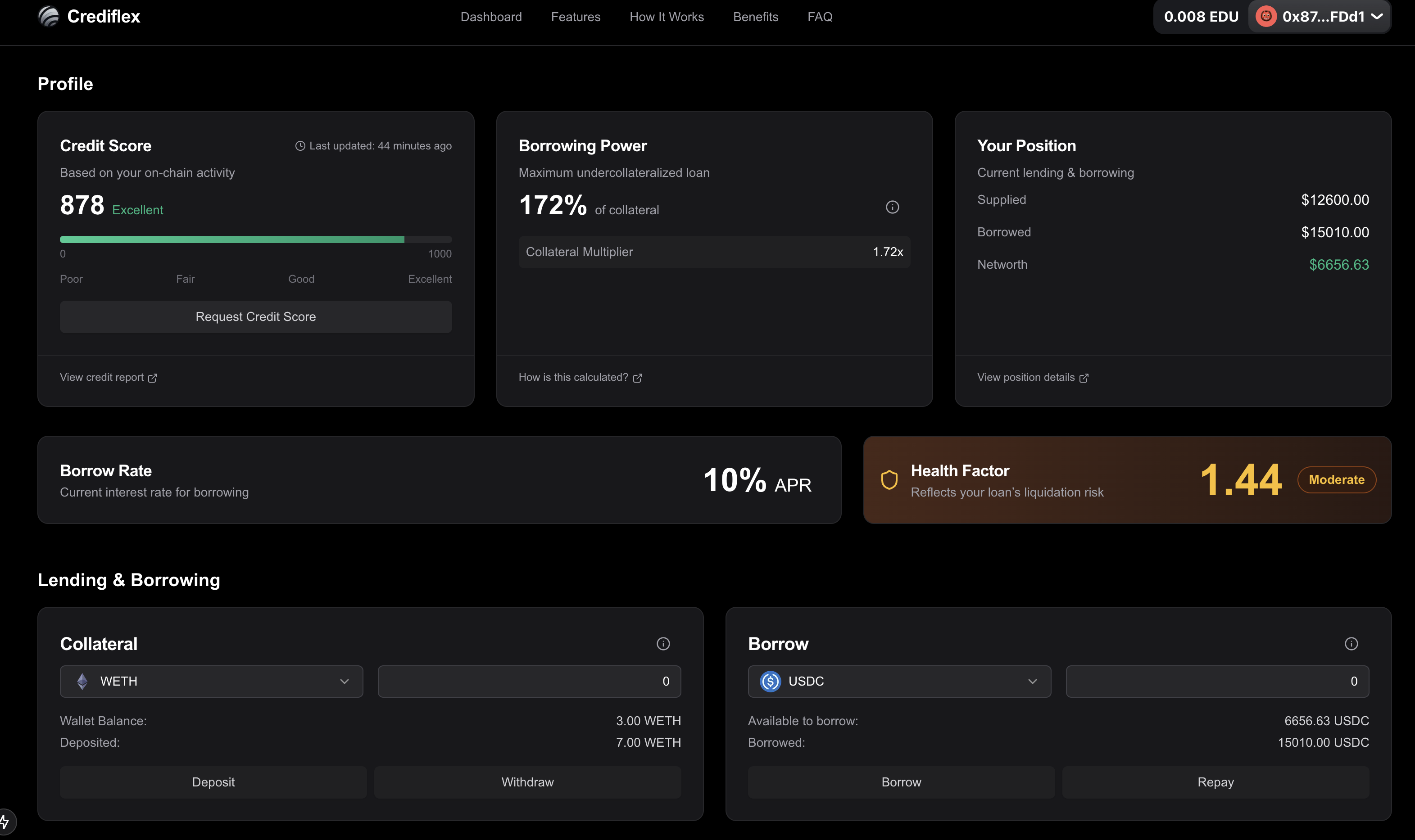

The C Score dynamically determines Loan-to-Value (LTV) ratios, enabling users to borrow more than their collateral based on their on-chain activities.

For the hackathon, users deposit mock WETH as collateral and borrow mock USDe as the asset, with borrowing limits calculated using updated parameters:

Wallet Age Score: Based on how long the wallet has been active.

Transaction Activity Score: Based on the number of transactions the wallet has performed.

Token Diversity Score: Based on the number of unique tokens worth more than $1 held.

ENS Ownership Score: Based on the ownership of ENS domains.

NFT Ownership Score: Based on the ownership of NFTs.

This implementation showcases secure data handling, efficient scoring, and practical lending mechanics for DeFi.

Crediflex is deployed on the EDU Chain testnet, while the credit scoring parameters are derived from Arbitrum Mainnet activity. This approach ensures realistic data is used for parameter calculation while maintaining a test environment for rapid development and validation.

Demo Video: Watch here

Slide Deck: Canva

Web App: Crediflex App

Github: Github

The C Score is a unique metric that evaluates a user’s on-chain activity using specific parameters. While there are plans to integrate many parameters in the future, the hackathon version of Crediflex uses the five parameters mentioned above.

AVS (Autonomous Verifiable Service):

Manages credit scoring requests.

Uses EigenLayer middleware to verify tasks securely.

Enables on-chain verification of off-chain data fetching and score computation.

zkTLS:

Fetches proofed and verifiable data from HTTPS endpoints.

Prevents tampering during data-fetching.

Ensures accurate, trustless data ingestion for score computation.

The user initiates a request for a C Score through the AVS contract.

The AVS contract generates a credit scoring task.

An Operator accepts the task.

The Operator collects on-chain data from Alchemy to acquire the necessary information for score computation.

The Operator also retrieves remote data over HTTPS, secured with zkTLS.

The gathered data is processed to compute the C Score.

The computed score is signed and verified using EigenLayer middleware.

The verified score is uploaded as a certificate to Pinata for decentralized storage.

The certificate is accessed using zkTLS to confirm its integrity and ensure it has not been tampered with.

The final score is returned to the AVS contract.

Note: The C Score is valid for 120 days. After this period, users must request a new score.

Users deposit mock WETH as collateral.

Users can borrow mock USDC based on their C Score-determined LTV.

Crediflex integrates with EDU Chain to bring new opportunities to learners and educators via inclusive, decentralized credit.

Borrow tuition or living expenses with on-chain academic credentials as proof of credibility.

Access capital for bootcamps, certifications, or online learning. Improve your C Score as you learn.

Institutions can offer “study now, pay later” with repayment governed transparently by C Score.

Instructors and contributors can qualify for loans based on their verified contributions.

Crediflex builds a financial foundation that’s transparent, earned, and on-chain.

Main Contract: 0xB5826abe2d27Fe01CdC98b394293Ead4f9f42883

AVS Contract: 0xb9a051f8fba685b18415150090afc61fe4500fab

Mocks:

usdcUsdDataFeed: 0x36Cd512c939af6a9340bC826c70af947a7c86845

wethUsdDataFeed: 0xEfA79f90A2a9400A32De384b742d22524c4A69d5

AVS (Actively Validated Service): Manages credit scoring requests and verifies responses using middleware for task validation.

zkTLS: Ensures data fetched from HTTPS endpoints is verifiable and tamper-proof.

EigenLayer Middleware: Provides secure and trustless task verification for C Score calculations.

Mock Contracts: Simulated USDe and WETH contracts for testing borrowing and collateral features.

Pinata: Utilized for uploading certificates using IPFS for decentralized storage.

Alchemy: Provides on-chain data access and management for enhanced protocol functionality.

EDU Chain Testnet: Deployment environment for contracts and protocol validation.

For more information, feel free to explore the contracts, visit the web app, or contact the team!

KYC Integration: Prevent Sybil attacks via identity linking.

Expanded Credit Scoring:

DeFi interaction history

Loan repayment behavior

Liquidation patterns

Score Algorithm Upgrades: Enhance precision and transparency.

Asset and Chain Support: Broaden protocol utility.

Real-Time Monitoring: Auto-refresh C Scores based on new on-chain activity.

MIT License

100

Ethena Hackathon 2024 - Top 10 Finalist - Best Overall Application - Winner - Most Innovative Use of sUSDe Rewards