FII (Forge Injective Insights) is a real-time analytics engine on Injective, delivering liquidity scoring, volatility metrics, and market risk intelligence from decentralized orderbooks.

FII (Forge Injective Insights) is a real-time market intelligence engine built on top of Injective’s decentralized orderbook infrastructure. While Injective provides powerful on-chain trading primitives, raw orderbook data alone does not provide actionable insight into market strength and risk.

FII transforms live orderbook data into structured analytics through a liquidity scoring engine, orderbook imbalance detection, microstructure volatility modeling, and cross-market ranking. By analyzing depth distribution, spread behavior, mid-price movement, and liquidity shifts, FII generates real-time liquidity and risk profiles for each market.

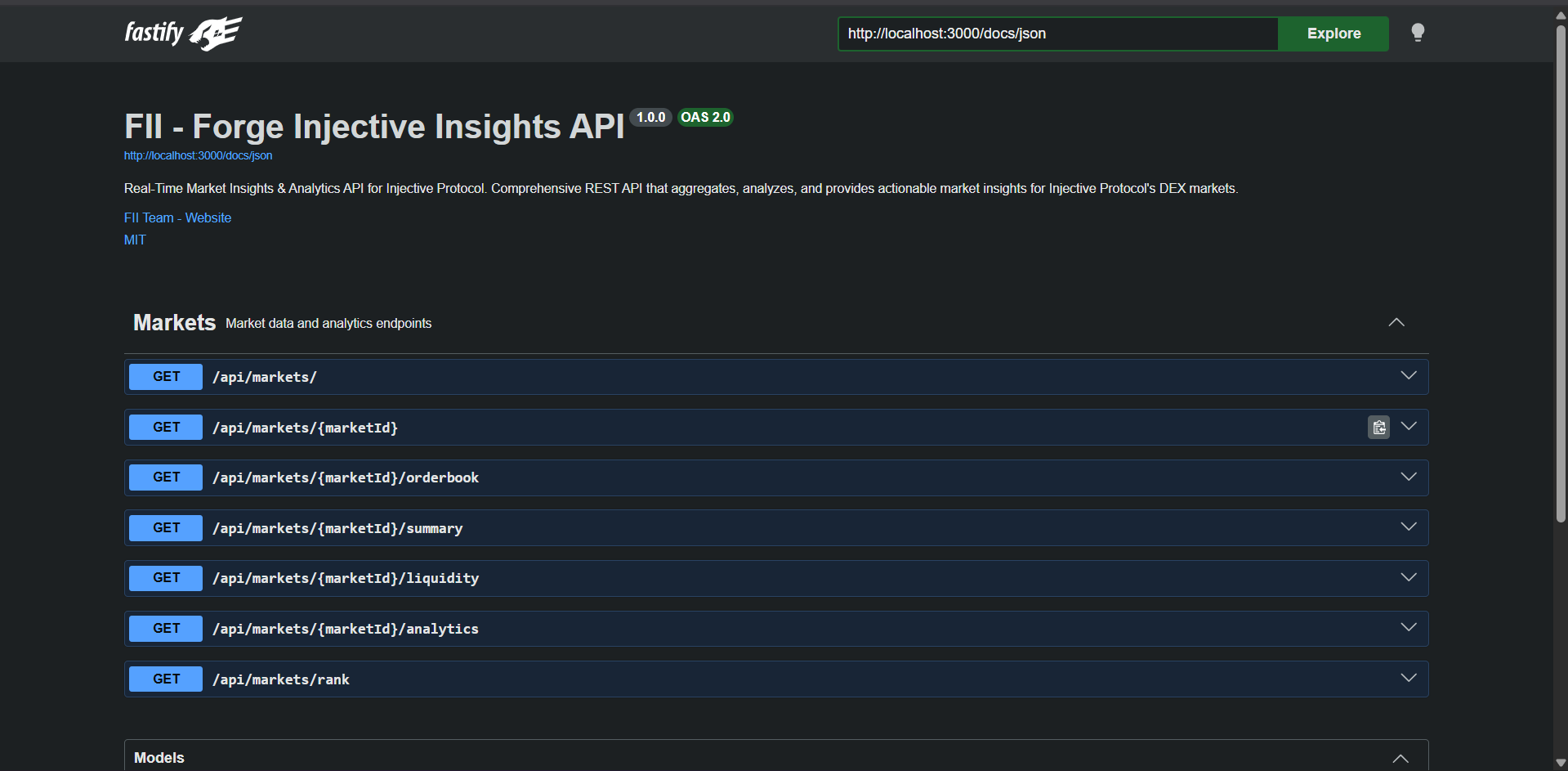

The system is designed as a composable analytics layer accessible via a clean REST API, allowing seamless integration into trading bots, dashboards, and DeFi protocols. Instead of simply exposing raw data, FII interprets it—turning decentralized markets into measurable intelligence.

FII aims to become the missing analytics layer within the Injective ecosystem, empowering builders and traders with real-time market awareness and data-driven decision-making.

During the hackathon, we designed and implemented a complete analytics pipeline on top of Injective’s TypeScript SDK.

We began by integrating live orderbook data and building core market endpoints. From there, we developed a liquidity scoring model that evaluates depth, spread, and imbalance across markets. We then implemented a microstructure volatility engine using a sliding window approach to measure real-time price and depth fluctuations.

Finally, we built composable analytics endpoints and a cross-market ranking system to compare liquidity strength across Injective markets.

The project evolved from a raw data API into a full market intelligence layer focused on liquidity analysis, volatility detection, and risk profiling.

Not currently raising funds. Open to ecosystem grants and strategic partnerships.